SHARE THIS ARTICLE

RWA Tokenization in 2026: Trends, Use Cases and Regulation Explained

At this very moment, the financial world is at the edge of major historic developments. Institutional players, across the spectrum from pension funds and family offices, to hedge funds, are starting to view blockchain technology beyond a speculative experiment. Tokenization of real-world assets (RWA) is becoming a foundational layer of financial infrastructure: the combination of tangible assets and the efficiency, transparency, and programmability of decentralized finance (DeFi) will be game changers.

Digital tokens will enable institutions to trade, lend, and collateralize physical and financial assets on blockchain networks with precision and speed. Moreover, the token design is the starting point for a new RWA financial system within Web3.

This guide focuses on RWA tokenization in 2026, and provides a comprehensive overview of how RWA tokenization works, the potential benefits, probable regulatory frameworks, potential use cases, and factors to consider to create systems for tokenized assets to support financial institutions. No matter if you are an investor, developer, or financial strategist, this guide from a token development company will prepare you for programmable finance.

What Are Real-World Asset Tokens?

When talking about RWA, we are referring to a process known as RWA tokenization, which involves creating a digital token to represent a physical, or traditional asset, on a blockchain network. With RWA tokens, there is a digital version of a physical asset, unlike a cryptocurrency or an NFT. RWAs derive their value from things that are real and proven.

RWA tokens represents:

-

Real estate properties

-

Corporate bonds and government securities

-

Commodities like gold and oil

-

Receivables and invoices

-

Carbon credits and ESG-compliant assets

Each of these is a token that is tied to some specific underlying asset. Ownership of that asset is recorded on a blockchain that is immutable, transparent, and programmable.

Being a fractional owner of an asset through tokenization gives an investor the opportunity to invest in higher-value assets that they may not have the higher value cash to buy the asset.

For example, instead of a company purchasing an entire commercial property that is worth $1 million, they could purchase 1 out of 1,000 tokens that each represent a value of $1,000. This way, smaller investors are able to invest in that asset.

Why Are Institutions Embracing RWA Tokenization?

Tokenization of Real-world assets is not a trend; it corrects the structural constraints of traditional finance.

-

Liquidity – Illiquid assets such as corporate debt or private real estate could now be traded 24/7 on digital marketplaces, allowing broader access for investors.

-

Operational Efficiency – Payment automation, distribution and compliance monitoring are done through smart contracts, removing manual tasks and operational risks.

-

Transparency and Auditability – Traditional reporting is exceeded through blockchain, providing immutable records of ownership and transactions, as well as asset performance.

-

Regulatory Compliance and ESG Integration – With embedded rules within the smart contracts of the tokens, regulatory frameworks, KYC, AML and even ESG are maintained for automated compliance.

-

Market Access and Fractional Ownership – Tokenization of large assets allocated previously inaccessible high-value assets to investors.

Tokenized RWA is projected to grow significantly. In 2023, the total value was 13.5 billion. It is 60% more compared to 2023. In 2023, it was projected by McKinsey to reach 2 Trillion by 2030. More than 260 billion are projected to be linked to RWAs in 2026, almost 19 billion deployed in DeFi.

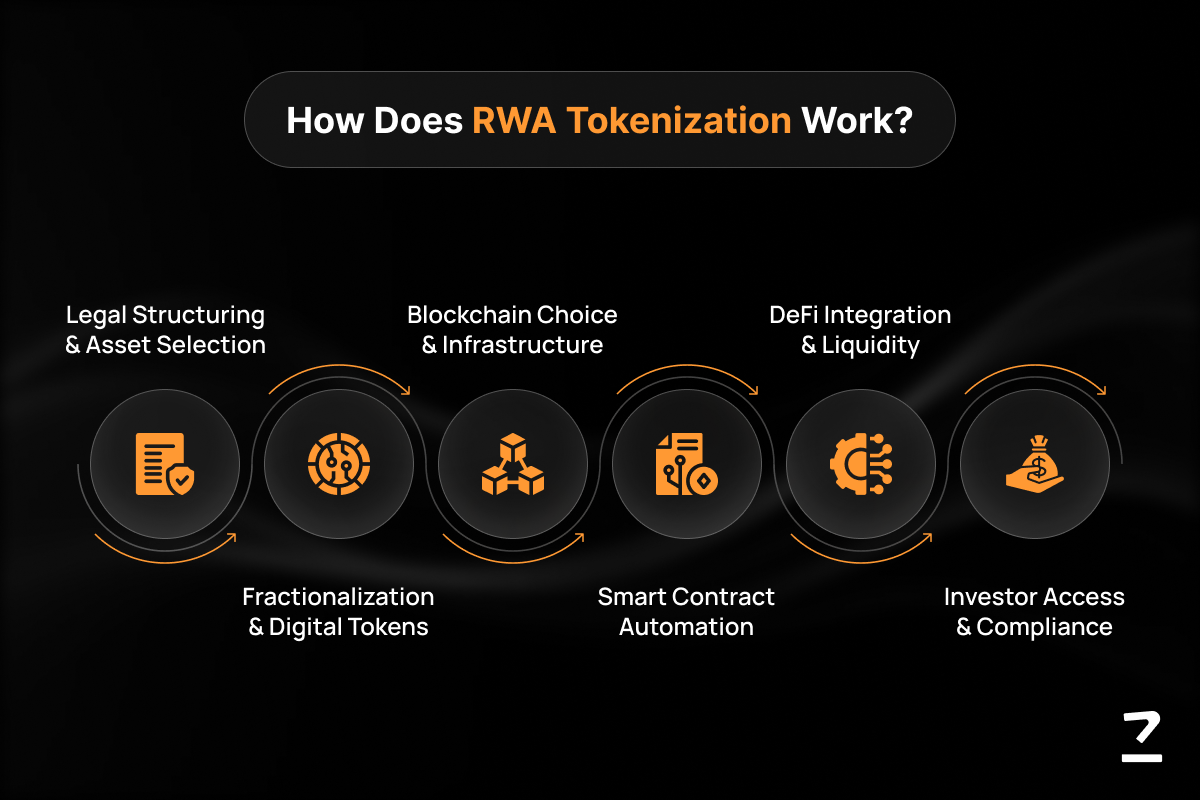

Step by Step Workflow of RWA Tokenization Development

Partnering with one of the best tokenomics advisory services is necessary. The process of tokenizing real world assets (RWAs) involves many crucial, intertwined, layers of an intricate, legal structure, technology, and operational processes.

1. Legal Structuring and Asset Selection

An asset must be placed legally, in advance of a token hitting the blockchain. This may include the asset being assigned a legal wrapper in the form of a trust, an SPV (Special Purpose Vehicle), or some other form of legally regulated entity. This practice ensures definable, legal, ownership rights, custodian and asset control, and legal enforcement.

The selection of the asset is equally important. Those assets that are most straight forward and have transparent methodologies of their overall valuations, consistent and stable, or predictably in a stream of consistent cash flow (i.e., payments), and whose cash streams are also legally structurally defined are the easiest to tokenize.

Most of the first-pass RWA tokenization tends to focus on:

-

Debt instruments (corporate or government bonds)

-

Money market funds (e.g., UBS tokenized MMFs)

-

Gold or easily identifiable commodities to be placed in custody

2. Fractionalization and Digital Representation

Once legally schemed and structured, the asset must then be fractioned or disaggregated and then assigned a digital token or representation on a blockchain.

The digital tokens are then assigned to one of the blockchain’s asset holder’s standard tokens (i.e., definitional standards) such as an ERC-20, or ERC 3643 (i.e., for permissioned assets) and other standards which might be defined by the blockchain platform.

The process of fractionalization is what actually allows for a broad range of diverse investors to hold proportionate ownership and to be automated through some type of token stream.

As an example, RealT is a company that has fractionalized tokenized assets for several hundred properties in real estate. This allows investors to make a full buy-in of $50 and will provide a stream of daily payments for their ownership in the form of rental income distributed daily.

3. Blockchain Selection and Infrastructure

It is important to be selective when it comes to choosing what blockchain to use.

Public networks have some validation and transaction privacy concerns and can be risky because of the potential lack of concern for certain regulations. However, they are much more transparent and more liquid.

Private networks might be more impotent because they are more compliant regarding specific regulations, however, they can lack governance.

XDC, Polymesh, Stellar, Algorand, and Ethereum are exemplary when it comes to fully supporting the issuance of simple tokens (and some more complex programmable tokens) for Real World Asset (RWA) systems.

Using oracle smart contract development on blockchain networks, you can automate asset distributions and enforce compliance directly on-chain.

4. Smart Contract Automation

Smart contracts are the engine of RWA tokenization. They handle:

-

Yield and interest distribution

-

Investor access control and accreditation verification

-

Redemptions and token buybacks

-

Compliance automation (KYC, AML, ESG)

By embedding these rules directly into code, operational overhead is dramatically reduced, and tokenized assets become truly programmable financial instruments.

5. Integration with DeFi Protocols

Once minted, RWA tokens can interact with DeFi platforms:

-

Lending markets (collateralized loans or yield generation)

-

Automated investment strategies

-

Liquidity pools and decentralized exchanges

-

Cross-chain transfer systems

This way, assets that are more tangible can be used for a variety of decentralized financial systems and bring heating in an economic tradable sense.

Popular RWA Tokenization Platforms and Tools

A variety of platforms specialize in RWA token issuance, infrastructure, and compliance. Notable names include:

Securitize – Tokenized compliance-ready securities

Polymath – Permissioned, institutional-grade token issuance

Tokeny – Fractional ownership solutions for real estate and funds

RealT – Tokenized real estate with automated income distributions

Centrifuge – Trade finance and invoice-backed tokenization

Ondo Finance – Tokenized treasury and yield products

ADDX – Private securities and corporate debt tokenization

Kaleido – Enterprise blockchain and token issuance infrastructure

These platforms bridge traditional finance with Web3 security, providing the tools and compliance frameworks necessary to scale RWA projects responsibly.

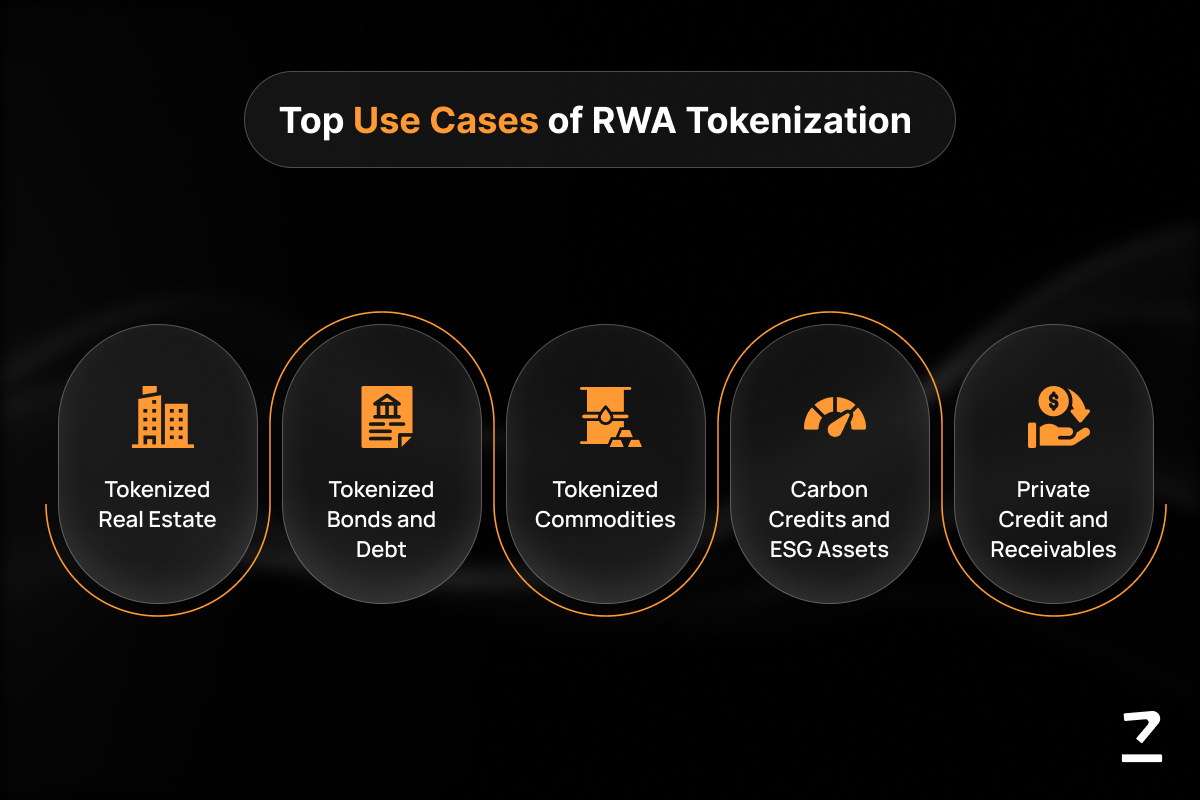

Top Use Cases of RWA Tokenization

Tokenized Real Estate

Owning a piece of a tokenized real estate property allows for high-valued property investments for both retail and institutional investors, making a share of property earn income at a proportional level. Investors enjoy tradeable value, reporting transparency, increased levels of liquidity, and the available trading property markets more efficiently than what traditional markets offer.

Tokenized Bonds and Debt

Institutions are able to provide digital bonds as collateral which automates the payment of interest, lessens the operating cost, and broadens the access to a wider range of investors. Compliance to regulations are embedded into these “smart” contracts and will assist to make secondary trading more liquid and transparent.

Tokenized Commodities

Gold-backed tokens like Tether Gold (XAUT) provide exposure to physical commodities without requiring investors to handle the underlying asset. AI-powered blockchain oracles ensure reserves are verified and continuously updated, offering institutional confidence.

Carbon Credits and ESG Assets

The automation of tracking, trading, auditing and reporting compliances at the investments of trading eco-friendly investments integrate the tokenization of carbon credits to make the marketplace more accessible.

Private Credit and Receivables

Tokenization of private credit, loans and invoices into the DeFi ecosystems is pioneered by platforms such as Maple Finance and Centrifuge. There, business collateralized tokens are traded for liquidity which make available for investors a structured level of yield.

Risks and Challenges in RWA Tokenization

Despite its potential, RWA tokenization presents unique risks:

-

Regulatory Fragmentation - Because the jurisdiction rules about such assets and securities vary, it would be more difficult to perform secondary market trading.

-

Faux Liquidity - Although trading the asset 24/7 is of the utmost importance, right now, there are not many secondary markets that offer significant liquidity.

-

Smart Contract Vulnerability - Tokenized RWAs become high-value targets. Because of this, coding and adequate smart contract audit services is very important.

-

Complex Custody - Having a secure integrated custody solution for both the digital and the physical asset is very important.

-

Market Integration - In the case that the DeFi protocols do not have any risk management or hedging strategies, the shocks of traditional markets will integrate into DeFi through the tokenized assets.

In the event that compliance structures advance, the successful projects will be the ones that innovation streamers and operational pragmatism are balanced.

Key RWA Tokens and Infrastructure in 2026

Leading infrastructure and RWA tokens shaping 2026 include:

Chainlink (LINK): Oracles for price feeds, proof-of-reserves, cross-chain messaging

Ondo Finance (ONDO): Tokenized treasuries and regulated yield products

Stellar (XLM): Low-cost settlement and DEX capabilities for RWA liquidity

XDC Network (XDC): Enterprise-focused tokenization and compliance

Algorand (ALGO): High-throughput Layer-1 for government bonds, real estate, and corporate securities

Quant (QNT): Cross-chain interoperability for RWAs

Polymesh (POLYX) and Realio (RIO): Specialized platforms for private, regulated securities and fractional real estate

Emerging tokens such as YieldBricks (YBR), TokenFi (TKNF), and Maple Finance (MPL) focus on fractional real estate, multi-asset yield aggregation, and private credit markets, illustrating the expanding diversity of RWA use cases.

Getting Started with Developing Custom RWA Tokens

For developers, financial institutions, and investors looking to engage with tokenized assets, the following steps provide a roadmap:

Select a legally viable asset – Identify assets with clear ownership, valuation, and stable cash flows.

Design a legal wrapper – Work with SPVs or trusts to structure compliant token issuance.

Choose blockchain infrastructure – Public or private chains must match security, scalability, and regulatory requirements.

Develop smart contracts – Automate yield, compliance, and governance rules.

Integrate oracles and custody systems – Ensure real-world verification of assets and secure storage.

Plan redemption and liquidity mechanisms – Protect investors with exit paths during volatility.

Test extensively – Tokenomics audit services help with contract audits, stress testing, and secondary market simulations are critical.

Focus on compliance – Adhere to local securities laws, KYC/AML, and reporting requirements.

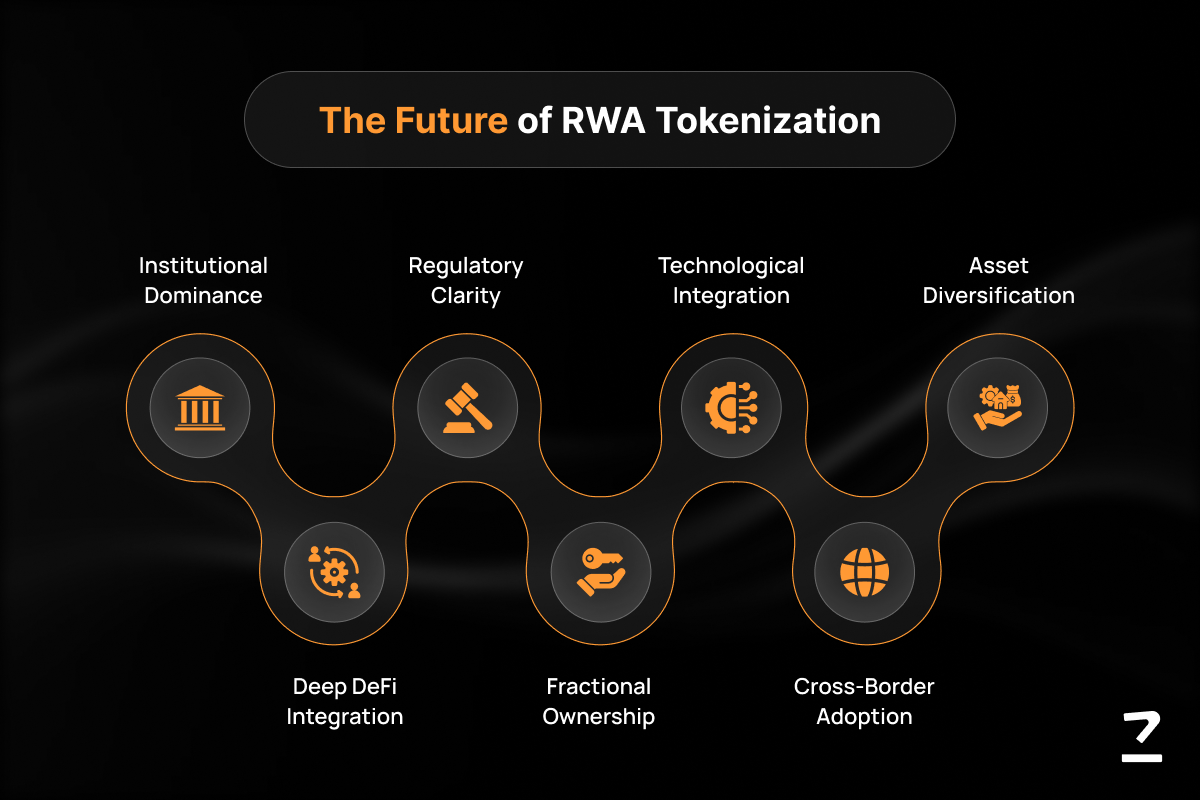

The Future Trends of RWA Tokenization

The future of RWA tokenization will be driven by rapid technological advancements, large-scale deployments, clear regulations, and accelerated institutional adoption.

We can fully expect the tokenized asset market to be worth anywhere from $16–$30 as the market continues to grow by 2030, which will solidify the trust investors, institutions, and regulators have placed in tokenization.

1. Institutional Dominance

Companies such as BlackRock and JP Morgan have recently decided to move from pilots into production-scale tokenized products in the US Treasury and private credit markets. As more and more key players begin to adopt tokenized products, they begin to validate the market and attract significant capital.

2. Regulatory Clarity

Increased legal frameworks such as the EU’s MiCA, US digital asset laws, and the new sandbox models in Singapore and Hong Kong will lead to less legal uncertainty, and more cross border transactions, in turn increasing investor confidence.

3. Technological Integration

-

Interoperability: Systems like Chainlink’s CCIP promote blockchain collaboration, allowing new liquidity to be unlocked.

-

Privacy Tech: ZKPs and homomorphic encryption are used to create secure, audit and compliant frameworks without exposing sensitive data.

-

AI Automation: AI and ML can help streamline tedious processes to help with asset valuation, risk, and compliance, which leads to less mistakes, as well as reduce costs.

4. Asset Diversification

The continually growing market of tokenization has moved well beyond real estate and private credit. Now the tokenization markets include infrastructure, ESG-linked assets, commodities, and even Intellectual Property.

5. Deep DeFi Integration

RWAs are being utilized more frequently as collateral in DeFi. This allows for lending, borrowing, and yield farming while integrating traditional finance with on-chain innovation.

6. Fractional Ownership

With the process of tokenization, financial access is more inclusive as high-value assets can be broken down and investors can acquire divisible and transferable portions of assets such as commercial real estate, private equity, and infrastructure. This improves liquidity and financial inclusion in previously untapped markets.

Move Forward to Institutional RWA Adoption with Codezeros!

Real-world asset tokenization in 2026 is more of a strategic evolution with real-world asset tokenization rather than a mere technological novelty. The features of automated compliance, programmable yield, auditability, and fractional ownership are transforming the methods of ownership and asset trading. However, the vision is only achievable through operational excellence, strong tokenomics, and regulatory compliance.

This is where Codezeros can prove to be the best-fit partner. Codzeros, with its operational excellence in the intersection of smart contract engineering, regulatory advisory, and tokenomics, empowers the design of a token to seamlessly fit and deploy RWA tokens of an institutional caliber within the DeFi space.

From the fractionalization of real estate to tokenized private credit and treasuries, tokenization development company can help with digitally developing finance with the architect of digital finance being equipped to provide scalable, fully compliant, and high utility tokenized assets to move real-world value onto the blockchain efficiently and securely.

Developers, institutions, and investors looking to breakthrough in RWA Tokenization, please contact us to transform cutting-edge technology into practical financial tools and build the future layer of the world’s financial system.

FAQs

1. How is an RWA token created?

An issuer acquires the real-world asset, structures it legally, and mints blockchain tokens that represent the asset. Token value is maintained via mint-and-burn mechanisms.

2. Can you give examples of RWA tokens?

Some examples are BUIDL (BlackRock USD Institutional Digital Liquidity Fund), PAX Gold (gold backed tokens), OUSG (US treasury backed tokens), and VBILL (VanEck Treasury Fund).

3. Are RWA tokens treated as securities or crypto-assets?

Depending on rights and jurisdiction, they may be securities (shares, notes, fund units) or MiCA-regulated crypto-assets like Asset-Referenced Tokens (ARTs) or E-Money Tokens (EMTs).

4. Do I need a license to launch RWA tokenization?

Possibly. Although some private-placement exemptions are available to accredited investors, platforms, exchanges, or MiCA tokens will be in need of a license.

5. How do investors get liquidity for RWA tokens?

Liquidity is available through regulated exchanges, processed OTC, and dedicated platforms. Tradable tokens would need access to secondary markets, along with market making and a KYC compliant system.

Post Author

Explore Deep's insightful blog posts that help businesses stay ahead of the curve, explore new possibilities, and unlock the full potential of blockchain technology

Build Institutional-Grade RWA Tokens with CodeZeros!

Tokenization is reshaping finance, but designing scalable, compliant RWA tokens requires expertise. CodeZeros specializes in tokenomics development, smart contract engineering, and regulatory integration, enabling institutions and developers to launch fractional real estate, tokenized treasuries, and private credit solutions efficiently. Partner with CodeZeros to transform your real-world assets into secure, programmable digital tokens that unlock liquidity, automation, and compliance.