SHARE THIS ARTICLE

How to Use AI for Your White Label Crypto Launchpad in 2026?

Token launches in 2026 are subjected to more oversight than ever before. Investors examine vesting schedules on-chain, regulators insist on compliance that can be proven, and communities want full disclosure from the very first announcement until the long-term token release is completed. Under such circumstances, launchpads are not only seen as tools for fundraising but rather as execution systems to judge whether a project gets trusted or discreetly fails after its launch.

This change of perception is the very reason why artificial intelligence has become one of the cornerstones in cryptocurrency launchpad development services. By 2026, the AI will not be regarded as an experimental add-on anymore, but will be the main factor in how the launchpads will be selecting the projects, implementing the tokenomics, spotting the fraudulent activities and controlling the investors’ communication in large volumes.

The entire creator token launchpad market has followed this trend. The market is expected to increase from $1.42 billion in 2024 to $6.22 billion in 2033, at a CAGR of almost 19.6 percent. The said growth is not marketing-driven but backed by the maturity of infrastructure. Launchpads based on manual processes find it increasingly difficult to comply with regulatory requirements and meet the investors’ expectations.

The AI-powered white-label launchpads turn the situation around by automating what were previously very delicate human workflows. The entire range of the AI-powered project scoring, automated vesting enforcement, and compliance checking has made artificial intelligence the very foundation of scalable launchpad development solutions in 2026.

If a company is planning to either enter or expand its operations in this market, then knowing the correct applications of AI will no longer be a choice. It will be the factor that determines whether you build a launchpad that survives scrutiny or the one that simply collapses at the first sign of it.

What Is a White Label Crypto Launchpad and How It Works in 2026

A white label crypto launchpad is a ready-made platform that can be customized and is ideal for those businesses that want to conduct the token sale using their own brand without having to create an entire infrastructure. By the year 2026, these types of launchpads serve as full-fledged ecosystems taking care of the fund raising, distributing the tokens, enrolling, compliance with regulations, investor dashboards, and other operations after the launch.

The modern platforms are totally unlike the early-generation launchpads, which concentrated almost exclusively on sale of tokens. Now they manage every step of the token lifecycle. Among their extensive list of services are the management of whitelist onboarding, KYC and AML verification, sale logic, vesting enforcement, claims, staking integration, reporting, and continuous investor communication.

Looking at the operational aspect, a white label launchpad development company offers the most necessary technical support while the client is busy with the branding, positioning in the market, and growing the ecosystem. The platform is set up fast, usually within 14 days to six weeks, in contrast to the six to nine months necessary for a custom build.

By the end of 2026, majority of white-label launchpad development companies will also be equipped with multi-chain support consisting of Ethereum, BNB Chain, Polygon, Arbitrum, and the up-and-coming Layer 2s. This will enable projects to have access to wider investor groups while at the same time keeping a similar execution logic across chains.

The most important feature of 2026 is the use of intelligence. The launchpad no longer acts as a passive platform. Artificial intelligence is now the most important factor to consider in decision making, risk evaluation, and trust building.

Why White Label Launchpad Development Dominates the Crypto Market in 2026

In 2026 the white-label launchpad development will be the leading solution in the market as the speed, compliance, and reliability are the main factors that matter more than the custom aesthetics. The process of the launchpad development from the ground up involves risks like technical debt, security, and maintenance costs which the few teams left cannot justify.

On the other hand, the white-label launchpad solutions are going to give a fast track to the start-up of the production-ready infrastructure which has already gone through the processes of audits, testing, and optimization in multiple launches. Thus, the development risk and the time-to-market are both reduced, allowing companies to concentrate on partnership, community building, and deal flow.

Regulatory pressure is yet another main driving force. The launch platforms in the jurisdictions enforcing the MiCA framework have to implement participant screening, geographic restrictions, audit trails, and reporting capabilities. Consequently, the providers of white-label launchpad development have started including compliance layers that are already built-in, thus reducing the legal exposure for the operators.

Cost efficiency has also been counted among the reasons. The standard price range for developing an AI-integrated white-label crypto launchpad is between USD 50,000 and USD 250,000 depending on scale and custom features. Meanwhile, custom-built solutions could easily surpass this range even before taking into account the expenses for audits, upgrades, and ongoing support.

In 2026, the infrastructure that works under scrutiny is the one that the market chooses. White label launchpads are the infrastructure that fits that criterion.

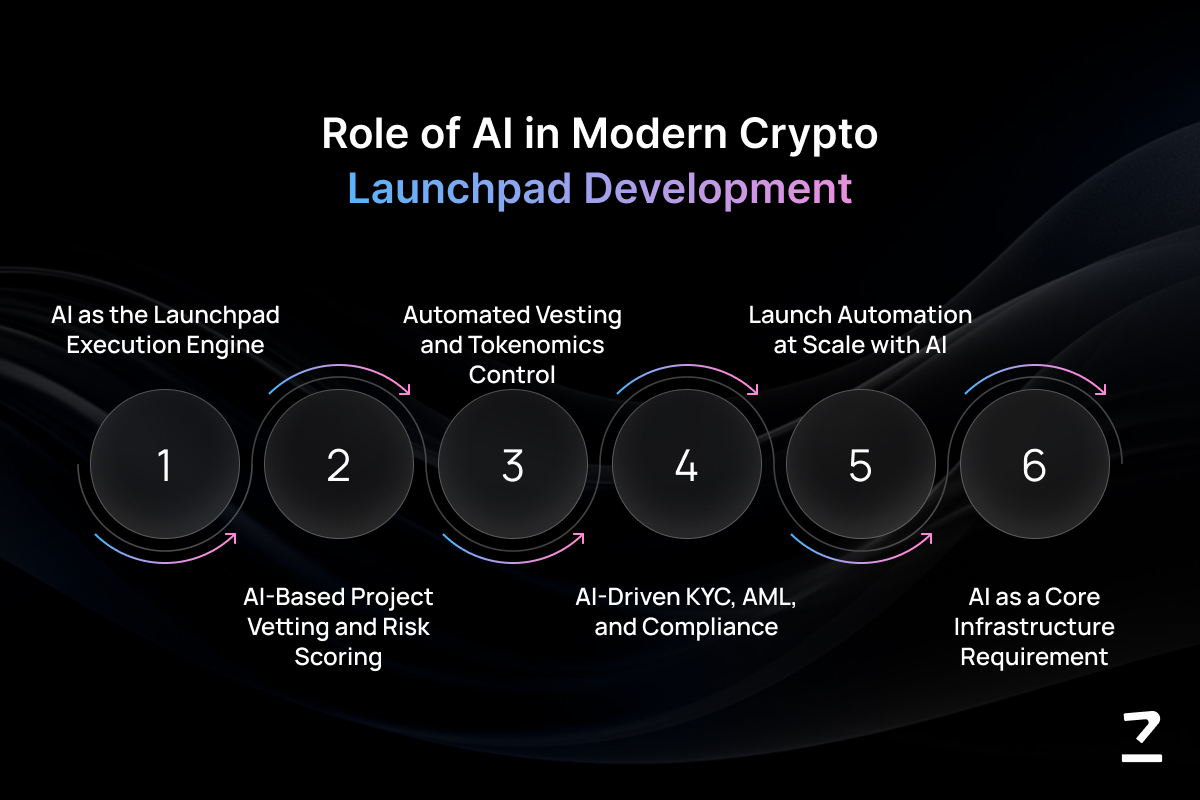

The Role of Artificial Intelligence in Modern Crypto Launchpad Development

The introduction of artificial intelligence has not only transformed the launchpad's role from a mere facilitator to a complete active execution system but also claimed the ground of AI-driven solutions in modern launchpad development. More often than not, human teams would not be able to analyze, in real-time, the same amount of behavioral, transactional, and historical data as the AI does.

AI in 2026 is the core factor in the project approval process. A machine learning model that reviews and predicts standard event costs, historical team behavior, funding patterns, concentration of wallets, and previous launch success rates generates a risk profile for the project before it is even approved. Such a machine-backed assessment is not only less prone to errors but also very much reliable considering the copious use of the scientific method.

AI, in the same manner, manages the operational reliability aspect. The schedules for vesting and the associated conditions such as claim and refund eligibility, staking rewards as well as refund conditions are strictly followed by the system thereby eliminating human-made errors during the very frequent and high-volume launch events.

The KYC checks that are far from perfect might only come across some of the culprits while the AI systems at the compliance layer will manage to identify all the criminals as it continuously monitors the transactional behavior and picks up anomalies that even the static KYC checks cannot capture.

For any launchpad development company that is working in 2026, AI is not a differentiator anymore. It is a necessity that comes in hand with all the benefits and requirements of investors' expectations, regulators' standards, and operational scaling without the risk of introducing systemic risk.

Key Benefits of Using AI in White Label Crypto Launchpad Platforms

A holistic benefit of AI integration is the quality of consistency. The AI-supported systems are bound to follow the laid-down rules in the same manner, thereby eliminating the uncertainty associated with the processes that directly affect trust.

AI, besides, lightens the burden on human resources. The number of investor support tickets falls when the timelines for allocations, vesting, and claims generated from smart contract data and AI-driven insights are made visible through dashboards.

The security of the system is greatly improved when AI is used to track the transaction patterns, the behavior of wallets, and access logs round the clock. The detection of threats is then done in a proactive mode instead of being reactive.

Looking at it from a business viewpoint, AI opens a door for new revenue streams. The AI-assisted deal discovery is a big win for project quality, which in turn boosts investor participation and platform credibility. Predictive analytics help in the formulation of better listing strategies, pricing models, and staking incentives.

The stated advantages are piling up and getting bigger as time goes on, thus making the AI-powered launchpad development solutions more capacitated as the ecosystems develop.

Core AI Capabilities Powering White Label Crypto Launchpads

Modern white label launchpads rely on multiple AI layers working together. Machine learning models handle classification and scoring tasks, while anomaly detection systems monitor behavioral patterns in real time.

Natural language processing supports investor communication, documentation analysis, and compliance reporting. Predictive models forecast demand, liquidity needs, and post-launch volatility.

Importantly, these capabilities are not isolated features. They operate as part of a unified execution stack that integrates directly with smart contracts, analytics dashboards, and administrative controls.

How AI Enhances Security for Your Crypto Launchpad in 2026

Security failures in launchpads rarely stem from a single exploit. They emerge from patterns: unusual claim behavior, coordinated wallet activity, or subtle contract misuse. AI excels at detecting these patterns early.

In 2026, AI-powered security systems monitor wallet interactions, transaction frequency, and contract calls in real time. When behavior deviates from expected norms, alerts are triggered automatically.

AI also strengthens compliance. Continuous AML monitoring identifies suspicious activity beyond static KYC checks. This is critical as regulators increasingly expect active monitoring rather than one-time verification.

By embedding AI into security workflows, launchpad development services move from defensive postures to preventive ones.

AI-Powered User Experience: Designing Intuitive Dashboards and Interfaces

The user experience provided by launchpads does not necessarily have to be very visually appealing. Rather it is already the right thing at the moment, and the AI-assisted dashboards turn complicated on-chain data into clear and easy-to-follow timelines, progress indicators, and alerts.

Customized views let an investor see only their points of interest: the size of the allocation, the vesting milestones, the availability of the claim, and the staking rewards. Machine learning recommendations help less people get confused and keep misinformation from circulating in public channels.

For the admin staff, AI presents usable insights instead of an ocean of data. It will lessen the burden of making decisions during launches and at the same time will give more control over operations without taking the risk of the contract-level intervention which might be costly and very uncertain.

Step-by-Step Implementation of AI in Your White-Label Launchpad

-

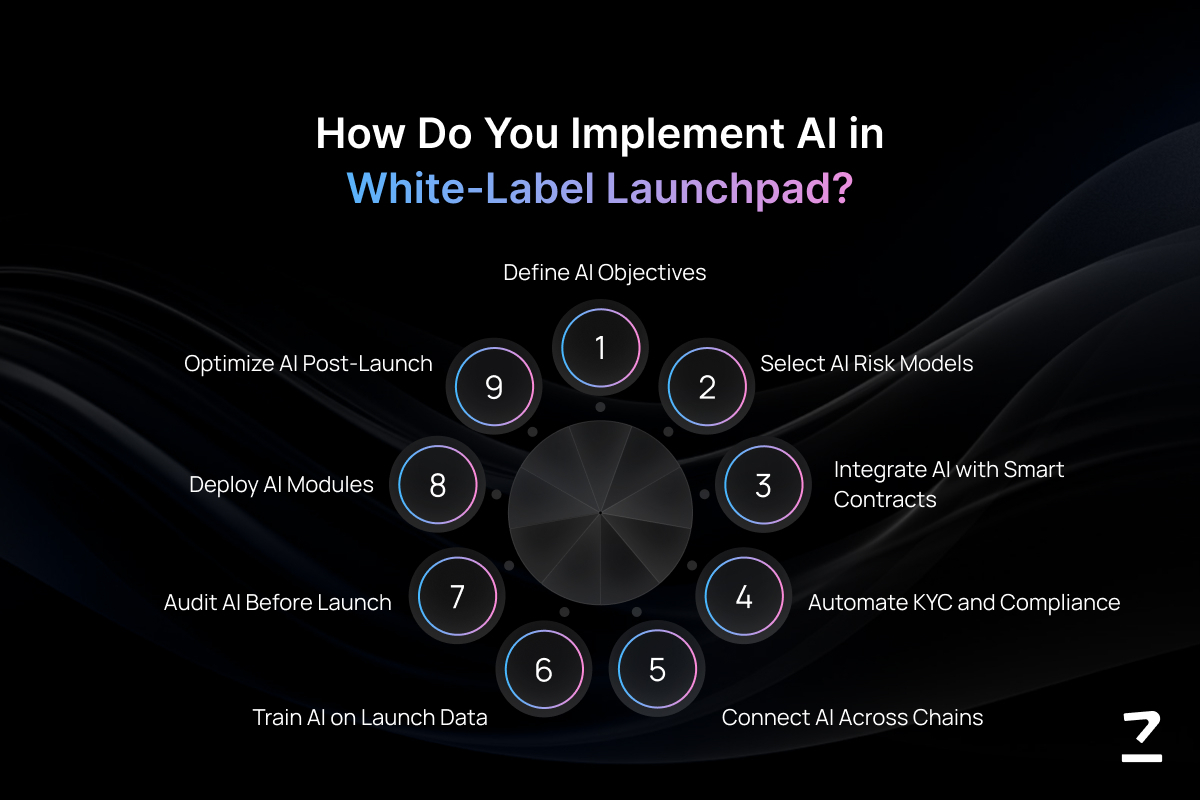

Defining Business Objectives and AI Use Cases for Your Launchpad: AI integration must begin with clear objectives. Whether the goal is improved security, better project selection, or reduced operational overhead, each AI module should solve a defined problem tied to measurable outcomes.

-

Selecting the Right AI Models for Token Vetting and Risk Scoring: Effective vetting models are trained on historical launch outcomes, token distribution patterns, and behavioral signals. These models help identify red flags early and improve overall platform credibility.

-

Integrating AI with Smart Contracts and Token Sale Logic: AI insights must feed directly into execution logic. Vesting enforcement, sale limits, and claim timing should respond dynamically to validated AI outputs without compromising determinism.

-

Implementing AI-Driven KYC, AML, and Compliance Workflows: AI enhances compliance by automating identity verification, transaction monitoring, and risk scoring across jurisdictions. This reduces friction while maintaining regulatory alignment.

-

Connecting AI Engines with Multi-Chain Infrastructure: Multi-chain support introduces complexity. AI systems must normalize data across networks to maintain consistent logic and reporting.

-

Training AI Models Using Historical Token Sale and Market Data: Model accuracy depends on data quality. Training should include both successful and failed launches to avoid bias and overfitting.

-

Testing, Auditing, and Validating AI Outputs Before Launch: AI outputs must be auditable. Testing ensures models behave predictably under edge cases and stress conditions.

-

Deploying AI Modules Within a White-Label Launchpad Architecture: Deployment should follow modular principles, allowing AI components to evolve without disrupting core infrastructure.

-

Monitoring AI Performance and Continuously Optimizing Models Post-Launch: AI is not static. Continuous monitoring and retraining ensure models remain accurate as market conditions change.

Cost, Timeline, and ROI of AI-Powered White Label Launchpad Development

In 2026, AI-powered white-label launchpad development costs between USD 50,000 and USD 250,000, depending on customization and scale. Deployment timelines range from two weeks to six weeks.

ROI is realized through faster launches, lower operational risk, improved investor trust, and diversified revenue streams including listing fees, commissions, and staking programs.

Compared to custom builds, white-label launchpad solutions deliver significantly faster payback with lower long-term maintenance overhead.

Future Trends: AI Innovations Shaping White-Label Crypto Platforms in 2026

The year 2026 marks the trend of white-label crypto launchpads transitioning into smart execution systems instead of being mere silent fundraisers. Manual project sourcing is being phased out in favor of AI-driven deal discovery, which operates on the basis of historical performance, tokenomics, and investor behavior to connect high-quality projects with the right investors.

Predictive analytics are now the core part of launch planning. AI models provide forecasts for demand, pricing ranges, allocation structures, and optimal sale timings, thus allowing platforms to cut down on volatility and stabilize better post-launch.

Smart contracts are transitioning from being static to dynamic. AI-driven contracts are smart enough to automatically change terms like vesting schedules, claim windows, and staking incentives depending on the verified participation and liquidity conditions, thus eliminating the need for manual intervention while still controlling the process.

Real-time behavioral analysis has made a significant contribution to investor protection. Continuous monitoring of wallet behavior and transaction patterns allows AI systems to detect coordinated manipulation, Sybil attacks, and insider activity at an earlier stage.

Investor communication is becoming more efficient through natural language AI. AI assistants provide real-time support for allocation queries, vesting procedures, and compliance issues. This not only lightens the load on the support team but also helps in averting misinformation during the course of active launches.

Regulatory compliance is evolving from a system based on static rules to one that relies on adaptive enforcement. AI-driven compliance engines are always on the lookout for any changes in regulations and thus, continuously adjusting KYC, AML and geographical restrictions across the relevant jurisdictions.

Cross-chain intelligence has become a necessity as launchpads cater to different blockchain networks. AI works to check the liquidity situation, as well as investors’ movements across various chains so that the market does not lose its balance after the launch.

Together, these capabilities are driving the emergence of semi-autonomous launchpad ecosystems, where AI enforces execution discipline at scale while human oversight focuses on governance and strategy.

How to Choose the Right AI-Enabled WhiteLabel Launchpad Development Company

The process of choosing a launchpad development company in 2026 entails a comprehensive evaluation of options that are not limited to feature lists and costs. The fundamental issue is spotting the provider who sees launchpads as execution systems rather than just front-end platforms.

A reputable whitelabel launchpad development partner exhibits not merely theoretical capability but proven experience with several launches. In this regard, audited smart contracts, documented security practices, and clear explanations on how AI models are trained, validated, and monitored over time are the necessary prerequisites.

AI maturity is a factor that is particularly significant. Providers should be capable of describing in detail how their AI systems deal with false positives, bias, and regulatory updates instead of considering AI to be a nontransparent entity. Support after launching is equally vital, since AI-based platforms will need continuous adjustment and governance.

The best partner provides infrastructure that passes the reliability test rather than merely impress during demos.

Experience AI-Powered White Label Launchpad Development Services with Codezeros

In 2026, successful launchpads are defined by execution discipline rather than marketing noise. AI-powered white-label launchpads provide the structural reliability required to operate under investor scrutiny, regulatory enforcement, and market volatility.

Codezeros delivers AI-driven whitelabel launchpad development services built for long-term ecosystem stability. By combining audited infrastructure, intelligent automation, and scalable multi-chain architecture, Codezeros enables businesses to launch platforms that operate predictably, transparently, and securely.

For teams seeking launchpad development solutions that prioritize execution integrity over short-term hype, can connect us. Codezeros provides the technical and strategic foundation required to compete in an increasingly demanding market.

FAQs

Is AI mandatory for white label crypto launchpads in 2026?

While not legally mandatory, AI is effectively essential to meet investor expectations, compliance demands, and operational scale.

How long does it take to launch an AI-powered white label launchpad?

Most platforms can be deployed within 14 days to six weeks using proven white label launchpad development solutions.

Does AI replace human oversight in launchpads?

No. AI augments human decision-making by enforcing consistency and surfacing insights, not replacing governance.

Are AI-powered launchpads compliant with global regulations?

When implemented correctly, AI enhances compliance by automating enforcement and adapting to regulatory changes in real time.

What industries benefit most from AI-enabled launchpads?

Blockchain startups, creator token platforms, gaming ecosystems, and enterprise tokenization initiatives benefit most due to scale and complexity.

Post Author

With a genuine love for all things blockchain, Jay is one of the Blockchain Enthusiasts and Consultants at Codezeros. With a fresh and innovative perspective on the world of blockchain, Jay provides strategic guidance and implementation support to clients across diverse industries and helps them unlock new opportunities.

Launch Your AI-Enabled White Label Crypto Launchpad Today

Codezeros offers AI-powered white-label launchpad development services designed for speed, security, and scalability. From automated project vetting to intelligent smart contract management and multi-chain deployment, our solutions ensure your token launches meet investor expectations, regulatory requirements, and operational excellence. Partner with Codezeros to build a launchpad that operates predictably, transparently, and efficiently in 2026’s competitive crypto ecosystem.