SHARE THIS ARTICLE

Optimistic Rollups vs ZK Rollups in 2026: Which Layer-2 Should You Build On?

Ethereum is the world’s primary smart contract platform and hosts over a thousand decentralized applications, decentralized finance protocols, and pieces of digital art (NFTs). While Ethereum 2.0 and its proof-of-stake mechanism work to build itself, the dreaded Layer-1 issues such as network congestion, costly gas fees, and slow transaction finality persist. It’s projected that 2026 will see over 85% of daily Ethereum transactions processed via Layer-2 solutions.

The leading technologies at this point are Optimistic Rollup and ZK Rollups. These enable transactions to be done off-chain, achieving Ethereum's security and decentralization. Optimistic Rollups are leading in total value locked (TVL) when ZK Rollups are seeing accelerated adoption with zkSync and Starknet. ZK Rollups in particular have seen triple digit growth in utilization. These technologies have become instrumental in achieving speed and security in performant blockchains at the lowest costs.

When partnered with a trusted and capable blockchain development service provider, you can be sure to have the most layer 2 optimizations and the best guidance on technologies available. It is crucial to read this blog to understand the differences, trade-offs and future trends of Optimistic and ZK Rollups to ensure your blockchain projects are future ready for 2026 and fully harness the potential of Ethereum Layer 2.

1. Optimistic Rollups Explained

Over the years, Optimistic Rollups (OR) have matured into providing better services. ORs work on the assumption that all transactions are valid. They only verify transactions when challenged. Because of this, ORs are able to achieve very high transactions without compromising their integration with Ethereum.

How They Work: The “Innocent Until Proven Guilty” Approach

Optimistic Rollups include three of the following major components.

-

Sequencers: These can be centralized or fully decentralized participants that bundle together and sort transactions that occur off-chain.

-

Validators: Participants in the network “watch” the sequencer and are willing to submit fraud or errors proof when transactions are found to be invalid.

-

Ethereum Smart Contracts: These are the “bridges” that write the transaction data and manage disputes. They ensure that Layer-1 security is maintained.

Transactions are done off-chain and are grouped offered to Ethereum as data. Among them. The network presumes that transactions are valid and only one of the “watchers” can submit proof to show that a transaction is fraud.

This type of framework gives the participants in focus a layer of Ethereum security and the Ethereum blockchain core values of decentralization and composability apply to the participants as Ethereum.

Key Advantages: Speed, EVM Compatibility, and Ecosystem Growth

Optimistic Rollups promise even more advantages in 2026:

-

Optimistic Rollups offer high transaction processing because they process transactions “off-chain.” It allows thousands of transactions to be carried out in a single second and quickly clears congestion on Ethereum.

-

Being EVM-compatible is another plus. Developers can deploy Ethereum smart contracts without altering any legacy code, and they can smoothly intertwine and integrate to existing decentralized applications (dApps).

-

Optimism and Arbitrum are massive platforms that contain expansive projects in DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and gaming. Therefore, they optimize liquidity, tools, and user adoption, which are critical for cost-efficient and economically preferred high-frequency operations.

Optimistic Rollups development companies include sophisticated toolsets for performance and operational reliability, as well as simplicity in integration from other networks to Ethereum. An expert Optimistic Rollups development company gives this advantage for applications with high throughput, EVM interoperability, and maturity in the network.

Drawbacks: Fraud Proofs, Withdrawal Delays, and Security Considerations

Despite the advantages, trade-offs are also present with Optimistic Rollups.

-

Fraud Proofs: They are a dependency of most Optimistic Rollups. It relies on other Validators to prevent malicious transactions. If a challenge is placed, false transactions could negatively influence a fund.

-

Withdrawal Delays: Consider when using Optimistic Rollups. When a user transfers a fund to Ethereum that was previously in an Optimistic Rollup, the fund can be locked for a maximum of 7 days as a result of the challenge period. This can be partially solved with special liquidity bridges. However, this solution is not as straightforward economically.

-

Censorship risks: Sequencers could, in theory, delay or censor specific transactions, though the decentralization of the validating networks do help mitigate this risk.

-

Reduced Privacy: Transaction specifics are viewable directly on the blockchain, meaning mysteriousness is non-existent on the more confidential side of things.

For some sensitive projects, the problems are indeed substantial where privacy, instant finality, or secure transactions are of utmost importance.

Major Players & Use Cases: Optimism, Arbitrum, and General DeFi

Due to the high frequency of transactions, Optimistic Rollups are commonly found in Ethereum based ecosystems:

-

Optimism: powers many of the top DeFi applications such as Uniswap and Synthetix, and provides advanced support for complex smart contracts and composable ecosystems.

-

Arbitrum: leading developer-centric DeFi, NFT, and gaming ecosystems, provides advanced gaming and DeFi tooling and ecosystem support.

Combining gaming dapps and social applications, and any additional high throughput focused applications, Optimistic Rollups continues to be the industry standard for Ethereum developers focused on speed and cost effectiveness.

2. ZK-Rollups Explained (Zero-Knowledge Rollups)

Different from Optimistic Rollups, ZK-Rollups (ZK-Rs) use a unique approach, winning over projects that prioritize instant finality and security, due to trust minimization, with the use of zero-knowledge proofs that keep the underlying data sealed.

How They Work: Mathematical Proofs and Instant Finality

In ZK-Rollups,

-

Operators process transactions off-chain and create zero-knowledge proofs.

-

State Commitments capture and summarize a blockchain’s current state and get stored on Ethereum.

-

Validity Proofs, fraud and false proof claims are Madden impossible as every transaction is Ethereum compliant.

In contrast to Optimistic Rollups, ZK-Rollups have no challenge periods. Once the proof is posted, transactions are final. If you hire ZK-Rollup developers for your requirements, it reduces withdrawal times to minutes or even seconds, and adds no reliance on validators.

This is even more applicable to high-value, financial functions, blockchains targeted at enterprises, and systems demanding privacy, high trust, and security.

Key Advantages: Security, Withdrawal Speed, and Future-Proofing

In 2026, ZK-Rollups gained more relevance based on further advancements:

-

Instant Finality: Zero-knowledge proofs are literally the only proof of correctness, hence settlement and assert withdrawal capabilities are greatly advanced.

-

Enhanced Security: Fraud is mathematically impossible without compromising the underlying cryptographic safeguard

-

Privacy: Transaction details are sealed, making it a perfect fit for financial services and regulated privacy-preserving DeFi.Future-Proofing. ZK-Rs are becoming more compatible with Ethereum smart contracts due to the development of zkEVM frameworks. This will allow for more widespread implementation of ZK-Rs.

-

Lower Long-Term Costs: Batching leads to lower on-chain gas costs than L1 transactions, despite the high computational costs of proof generation.

ZK-Rollup technology is particularly advantageous for projects with high security, privacy, and rapid withdrawal requirements.

Drawbacks: Complexity, Proof Generation Costs, and EVM Limitations

There are still several issues to be addressed:

-

Technical Complexity: ZK-proof implementation requires the utilization of complex forms of cryptography, and in turn, more time-consuming engineering.

-

EVM Compatibility: Not all smart contracts will be compatible on their own, and may need to be modified for zkEVM.

-

Operational Costs: It requires a lot of computational power to generate a proof, especially for proof generation in high throughput systems.

-

Early Stage Tooling: Developer resources, while getting better all the time, are still in their early stages and cannot keep up with the advancement of Optimistic Rollups.

These considerations, particularly for resource-constrained and rapidly iterative projects, will need to be addressed on a case-by-case basis.

Major Players & Use Cases: zkSync, Starknet, Polygon zkEVM

The most relevant ZK-Rollups are:

-

zkSync: General-purpose contracts and payments focus; DeFi.

-

Starknet: DeFi, NFT marketplaces, and high-throughput dApps.

-

Polygon zkEVM: Zero-knowledge scalability and EVM compatibility.

-

Use Cases: Regulated digital assets, enterprise-level solutions, privacy-preserving DeFi, and high-value transactions.

Optimistic vs ZK-Rollups: Head-to-Head in 2026

When comparing ZK-Rollups with Optimistic Rollups for 2026, we will showcase differences in speed, cost, and security, which will guide 2026 projects to an optimal Layer 2 solution.

Transaction Speed and Finality

When it comes to finality in transactions, Optimistic Rollups are faster than ZK Rollups. Optimistic Rollups confirm transactions off-chain, which allows for near instantaneous interactions. However, on-chain finality requires an on-chain fraud proof, which could take hours, or in some cases, days to finalize on Ethereum depending on congestion.

On the other hand, ZK Rollups finalize through the use of fraud proofs and, because of the proofs, transactions are final, and withdrawals will not face on-chain fraud proof delays.

Security Models and Trust Assumptions

Although Optimistic Rollups and ZK Rollups are based on different security models, ZK Rollups carry less trust assumptions than Optimistic Rollups. The fraud proof system relies on one or multiple validators to watch the system and submit the proof for a chain of bad actions from the fraudulent actor. This system induces risk since it’s possible that proof won’t be submitted.

Alternatively, ZK Rollups carry low trust assumptions and possible attack vectors because ZK Rollups provide a mathematically provable system of securing the chain.

EVM Compatibility and Tooling

From an EVM, tooling, and overall ecosystem stance, Optimistic Rollups are more advanced than ZK Rollups. This is because ZK Rollups and Optimistic Rollups are on the same tooling level, and Optimistic Rollups are more advanced from an EVM and overall ecosystem stance.

On the other hand, ZK Rollups are more advanced than Optimistic Rollups regarding EVM and overall ecosystem. ZK Rollups are less advanced than Optimistic Rollups regarding tooling, making them less advanced overall.

Cost Efficiency: Gas Fees and Operational Overhead

Most of the time, the operational overhead and challenge period gas costs can be offset with execution costs by using Optimistic Rollups (ORs).

Zero-Knowledge Rollups (ZK-Rs) are able to reduce the on-chain gas costs because of the efficient batching, but the costs associated with the processing of producing the zero-knowledge proofs add complexity and resource costs.

Technological Maturity and Roadmap

ORs have a set predictable ecosystem that makes advanced maturity possible.

ZK-Rs are a fast-growing sector due to recent innovations in zkEVM frameworks and hybrid rollups, and with the explosive potential of future adoption and growth, they can be expected to continue to mature.

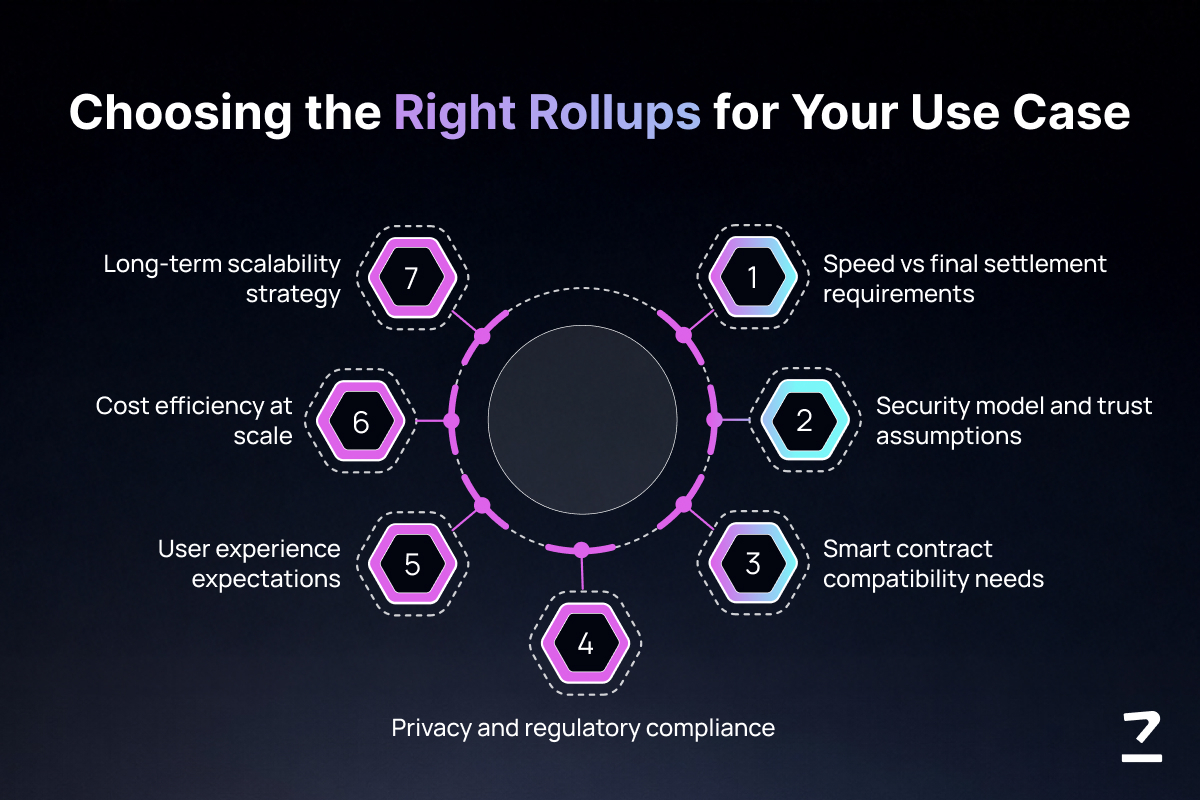

Deciding Factors: Choosing the Right Rollup for Your Use Case

Selecting the Layer 2 solution that fits best is primarily a decision based on the transaction goals, the private sector, and the types of applications that are being supported. The trade-offs that are present in costs, speed, and security will help dictate where the optimal choice is.

When to Choose Optimistic Rollups

-

Massive social networks where there is a demand for high transaction throughput.

-

Traditional DeFi services that can use the entire Ethereum contract.

-

Gaming applications where there is a need for ultra-responsive interactions and user experience.

When to Choose ZK-Rollups

-

ZK-R should be used where there are commerce streams that need transaction security and confidentiality.

-

Enterprise applications that require a specific case for audit; ZK-R are best for compliance to regulation frameworks.

-

Applications where there is a demand for high transaction throughput and the end user experience is primary.

Hybrid Models and the Emerging Converging Landscape

Hybrid models are starting to elevate the field due to the combination of the scalability and speed of ORs paired with the security and privacy of ZK-Rs. This convergence provides an opportunity for businesses and platforms to balance performance and safety, which means the adoption of Layer-2 will continue to accelerate in 2026 and beyond.

Major Layer-2 Trends and Innovations in 2026

Layer-2 technology trends in 2026 are rapidly evolving. Some examples of trends are:

-

Growth of Ecosystem and Hybrid Rollups: Recently developed Hybrid Rollups, that merge Optimistic and ZK Rollups, are successfully dominating the L2 ecosystem. This combination allows for optimizing both technologies, giving a complete L2 ecosystem. ZK-Rollups in Web3 ecosystem are used for operations in a privacy-sensitive environment, while Optimistic Rollups are leveraged for high-volume throughput.

-

Updates in EVM Compatibility and Developer Tooling: The zkEVM frameworks, OR SDKs, and Monitoring dashboards have matured in 2026. The updated frameworks and toolkits have automated many processes and streamlined development, lowering the margin of error and accelerating the development cycle. This shift has decreased the development cycle for both enterprises and startups.

-

Shifting Regulatory and Corporate Adoption: In a compliant environment, Layer-2 solutions can be implemented. ZK-Rs are used for operations in a privacy-sensitive environment, while Optimistic Rollups are leveraged for high-volume throughput. Financial institutions have started using ZK-Rs for this reason.

-

New Emerging Use Cases: In the gaming industry, there are real-time in-game economies that have leveraged Optimistic Rollups. Privacy-preserving applications such as secure asset transfers, confidential voting, and private auctions use ZK-Rollups. The DeFi industry enables faster, cheaper trading and lending.

Navigating the Future of Layer-2 Rollups Development with Codezeros!

The Layer-2 landscape continues to evolve, including the further development of Optimistic Rollups and ZK-Rollups. Optimistic Rollups provide greater accessibility, increased throughput, and a more mature ecosystem versus ZK-Rollups. ZK-Rollups have instant finality, greater privacy, and more sophisticated cryptographic protections. In the future, hybrid models of ZK and Optimistic Rollups will likely integrate the benefits of both.

Get in touch with Codezeros, the leading Optimistic and ZK-Rollups development company to explore the Layer-2 environment and make scalable, safe, and cost-effective blockchain solutions to optimize your business needs.

FAQs:

1. What are the main differences between Optimistic and ZK-Rollups in 2026?

With Optimistic Rollups, the fraud proofs are the most distinguishable and are utilized to assume all transactions are valid. They also provide EVM compatibility and are simpler to implement. ZK-Rollups are the most sophisticated of all, with instant finality and higher security. However, a zkEVM fusion may have to be integrated.

2. Which Layer-2 solution is better for high-value transactions?

Over ZK-Rollups, Optimistic will be a poor choice because of its lack of instant finality, the security and privacy of cryptography, and the protection.

3. How do fraud proofs work in Optimistic Rollups?

The fraud proofs in Optimistic Rollups are built in such that multiple validators are watching the transactions off the chain and fraud proofs are sent to Ethereum in the event that a transaction is found to be invalid.

4. Are ZK-Rollups compatible with all Ethereum smart contracts?

No, there is not. However, zkEVM frameworks have been introduced to greater compatibility. Some contracts, however, do still require adaptation.

5. Can developers use hybrid models combining both rollup types?

Yes. Hybrid models leverage Optimistic Rollups for high-volume transactions and ZK-Rollups for high-value or privacy-sensitive transactions – so they get the best of both!

Post Author

As a distinguished blockchain expert at Codezeros, Paritosh contributes to the company's growth by leveraging his expertise in the field. His forward-thinking mindset and deep industry knowledge position Codezeros at the forefront of blockchain advancements.

Optimistic Rollups vs ZK Rollups in 2026: Which Layer-2 Should You Build On?

Know about Optimistic and ZK-Rollups in 2026. Compare speed, security, and use cases to choose the best Layer-2 solution for Ethereum projects.

Blogs

Our Latest Blogs

Discover valuable industry insights and stay up-to-date with the latest updates by exploring our curated collection of recent blog posts.

Let us know your requirement

We know ideas matter, we are the product of one. We Provide Full Assistance In Your Business