SHARE THIS ARTICLE

How Global Regulatory Trends Are Shaping Blockchain Development Projects

Regulation has become one of the strongest forces shaping blockchain today. What began as a technology driven by decentralization and open access is now being defined by legal frameworks across the United States, Europe, the UAE, and Asia. Governments are setting clear rules for token offerings, stablecoins, exchanges, and digital assets. For blockchain projects, this is no longer a secondary concern. Blockchain development companies must plan for compliance at the start, not after launch.

This change is reshaping how blockchain development companies and blockchain development services operate. Features like KYC and AML checks, audit-ready smart contracts, and permissioned ledgers are no longer optional. They are becoming part of the standard toolkit for enterprises and startups that want to scale in regulated markets.

In this blog, we look at how global regulatory trends influence blockchain development projects from both a technical and strategic perspective. The goal is to help product owners, CTOs, compliance leads, and blockchain stakeholders understand the direction of regulations and how to align projects with them. You will see how different regions are setting the pace, what these rules mean for development choices, and why working with the right blockchain development company is critical for success.

Global Regulatory Landscape in Blockchain

What factors are driving the latest blockchain regulations?

Governments are tightening their approach to blockchain to reduce risks like money laundering, safeguard investors, and maintain market stability. Recent studies show that jurisdictions representing nearly 70% of global crypto activity now operate under defined policy frameworks. The focus is shifting from viewing blockchain as a niche experiment to treating it as a regulated part of the financial system. This has created frameworks that developers must respect when building products for global use.

Several forces are shaping why governments are moving from light guidance to firm rules:

Financial crime prevention

Crypto has been linked to fraud, money laundering, and illicit transfers. Regulators want stronger AML and KYC controls to track and verify transactions.

Investor protection

Market crashes and token failures have caused major losses for retail and institutional investors. Rules now demand greater transparency and disclosure from blockchain projects.

Market stability

Events like stablecoin collapses have shown how digital assets can impact broader financial systems. Regulators see oversight as a safeguard against systemic risk.

Mainstream adoption

Blockchain is moving into payments, supply chain, and enterprise use cases. Legal clarity builds trust and encourages wider adoption among banks, corporations, and governments.

Why does this matter for blockchain development companies?

A blockchain development company is now expected to create solutions that reflect these global realities. Projects without compliance features risk being locked out of markets. Demand is rising for blockchain development services that include:

-

Built-in KYC and AML modules

-

Audit trails for regulators

-

Permissioned or consortium blockchain setups for industries like finance and healthcare

-

Token designs that meet legal classifications

Understanding the regulatory landscape is now a critical step in planning and executing blockchain development projects. For businesses and stakeholders, compliance is not just a legal requirement but also a competitive advantage.

Key Global Regulations and Frameworks

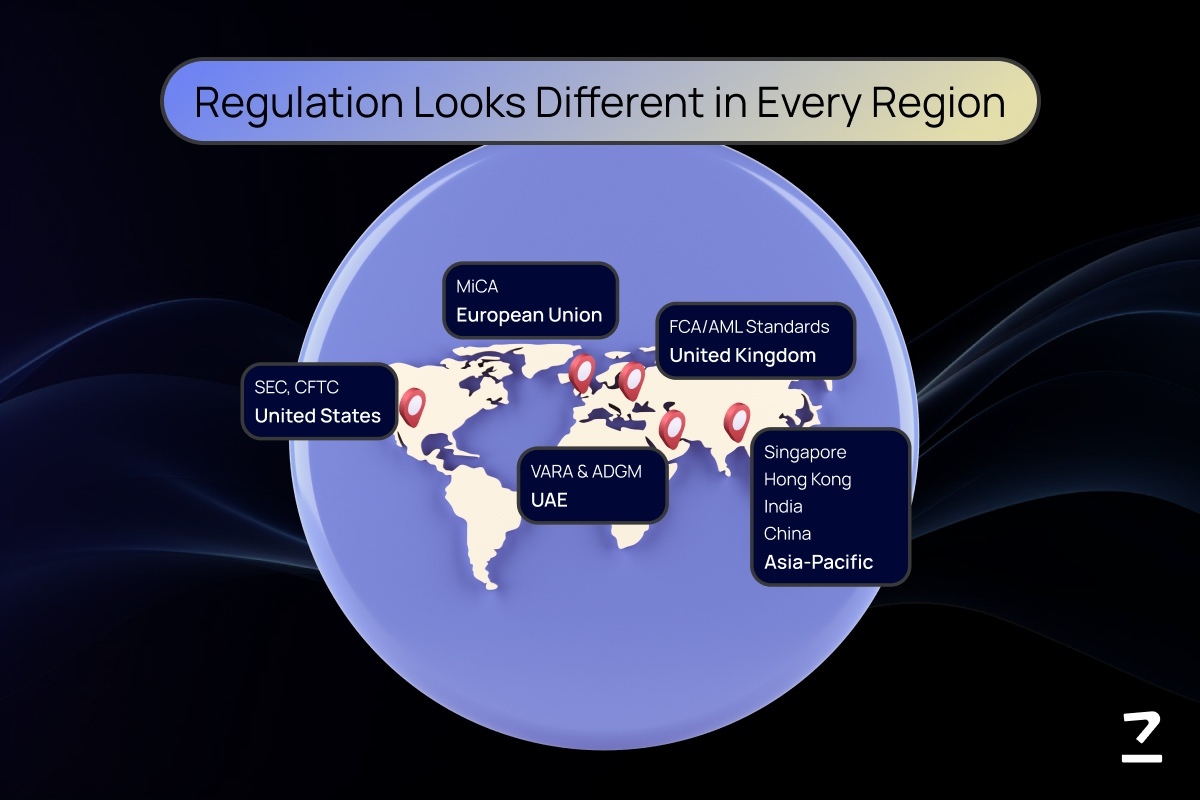

What are the major regulatory frameworks shaping blockchain development?

Regulation looks different in every region, but a few jurisdictions are setting the pace for the rest of the world. For developers and stakeholders, these frameworks matter because they decide how tokens are classified, how exchanges operate, and what features must be built into blockchain systems.

European Union – MiCA (Markets in Crypto-Assets)

The EU has taken one of the most structured approaches through MiCA. It creates a single rulebook for crypto-asset issuers and service providers across all member states. Because MiCA requires licensing, governance standards, and clear consumer protections, developers targeting Europe are building systems that are audit-ready, transparent, and secure from the ground up. In practice, this means features like transaction traceability, reporting dashboards, and robust stablecoin frameworks are becoming part of the baseline for projects.

United States – SEC, CFTC, and Treasury Oversight

The U.S. doesn’t yet have one unified law, but agencies play clear roles. The SEC treats many tokens as securities, the CFTC regulates derivatives, and the Treasury enforces AML and KYC through FinCEN. Together, these create a patchwork that developers must navigate. For many blockchain projects, this involves legal review of token design, strong identity checks, and compliance reporting baked into the code. U.S.-focused blockchain development services now often include both technical builds and compliance consulting as a package.

United Kingdom – FCA and AML Standards

The UK applies financial market rigor to crypto through the Financial Conduct Authority. Registration, AML, and counter-terrorism financing rules are strict, which pushes developers to prioritize identity verification, reporting tools, and security audits within their platforms. While this adds cost and time, many projects see the trade-off as worthwhile for gaining access to a highly regulated but stable market.

United Arab Emirates – VARA and ADGM

The UAE stands out as a hub that blends innovation with oversight. Regulators like VARA in Dubai and ADGM in Abu Dhabi have clear licensing regimes designed to attract blockchain businesses. At the same time, AML and consumer protections remain strict. Developers building for this market often integrate licensed stablecoin payments, on-chain KYC, and regulatory dashboards. The result is an ecosystem that is vibrant but firmly guided by rules, giving both startups and enterprises room to innovate under supervision.

Asia-Pacific – A Diverse Landscape

Asia doesn’t move as one.

Singapore provides clarity under its Payment Services Act, making it one of the most innovation-friendly environments.

Hong Kong introduced a 2025 stablecoin regime that demands 100% reserves, signaling a cautious but open stance.

India discourages speculative crypto with high taxes yet promotes blockchain for enterprise and government use.

China maintains a ban on public trading but continues to push blockchain infrastructure and its digital yuan.

Each jurisdiction sets its own tone. MiCA promotes trust and consumer safeguards. The U.S. emphasizes classification and enforcement. The UAE opens the door to adoption but insists on AML. Asia is fragmented, forcing teams to adapt case by case. For a blockchain development company, the ability to build solutions that reflect these realities is quickly becoming a mark of credibility. Clients increasingly expect blockchain development services that deliver not just technology, but compliance-by-design.

Implications for Blockchain Development Projects

How do global regulations influence blockchain development companies?

The rise of structured regulation is changing what clients expect from development partners. A blockchain development company is no longer judged only on its technical skills. It must also design solutions that satisfy licensing requirements, integrate compliance features, and pass audits. This shift has pushed blockchain development services into three clear directions:

Compliance-first design. Smart contracts and decentralized applications are being built with audit trails, identity verification, and transaction monitoring included by default.

Token structuring. Developers must account for how tokens are classified—utility, security, or stablecoin—because each comes with different obligations under MiCA, SEC guidance, or regional laws.

Security as regulation. With regulators scrutinizing hacks and data leaks, security audits, penetration testing, and ongoing monitoring are now legal necessities as much as technical best practices.

What technical challenges do regulations create for developers?

Compliance introduces complexity.

Privacy and transparency must coexist. Developers often combine on-chain proofs with off-chain data storage to meet both GDPR-style privacy laws and the blockchain’s need for visibility.

Oracles and identity systems must be verified. Faulty data feeds or weak KYC modules can lead to non-compliance as well as security risks.

Cross-border operations require flexibility. A project built for Europe under MiCA may need adjustments to meet U.S. or UAE standards.

Why are blockchain development services in higher demand?

Global regulations are pushing businesses to seek expert partners who understand both the technology and the law. Enterprises and startups prefer working with a blockchain development company that can:

-

Build compliant DeFi platforms and exchanges

-

Create permissioned or consortium chains for regulated industries

-

Deliver tokenization projects that meet disclosure and reserve requirements

-

Provide continuous support as laws evolve

In practice, regulations are turning compliance into a competitive edge. Projects that can prove they are compliant are more likely to gain institutional adoption, attract partnerships, and expand globally. Those that ignore compliance risk being locked out of key markets.

Challenges and Strategic Responses

What challenges do blockchain projects face in a regulated environment?

Stronger regulation brings stability, but it also creates friction for developers and businesses. The most common hurdles include:

Regulatory fragmentation: Rules differ across jurisdictions, creating a patchwork that complicates cross-border projects. A solution built for MiCA compliance may need major revisions to work under U.S. or Asian laws.

Rising costs and timelines: Licensing, audits, and compliance integrations increase both project budgets and delivery schedules. Many firms underestimate this at the planning stage.

Uncertainty and shifting rules: Regulations continue to evolve. A token classified as a utility today could be reclassified as a security tomorrow, which forces projects to adapt quickly.

How can blockchain development companies respond to these challenges?

Instead of seeing regulation as an obstacle, leading development teams use it as a design principle. Strategic responses include:

Building compliance into the architecture: By integrating KYC, AML, and audit features from day one, projects avoid costly retrofits later.

Adopting flexible frameworks: Modular designs and permissioned chains allow faster adaptation when laws change or when projects expand to new regions.

Using RegTech tools: Machine learning and analytics can automate compliance reporting, transaction monitoring, and fraud detection, reducing manual workload.

Partnering with regulators: Many successful projects open dialogue with local authorities early. This proactive approach reduces risk and builds trust with investors and users alike.

Compliance is becoming a marker of maturity. Projects that can prove they meet regulatory standards attract institutional adoption and gain an edge over competitors. For stakeholders, the lesson is clear: align early with a blockchain development company that treats compliance as part of the solution, not as an afterthought.

The Road Ahead for Blockchain Regulation

What future trends should blockchain developers monitor?

Regulation is not standing still. The next few years will shape how blockchain systems are designed and deployed globally. Some clear trends are already emerging:

Push for harmonization. Global bodies such as the Financial Action Task Force (FATF) and the Financial Stability Board (FSB) are encouraging countries to align their crypto rules. For developers, this could mean fewer conflicting requirements and smoother cross-border operations.

Rise of central bank digital currencies (CBDCs). As more governments explore CBDCs, blockchain systems will need to integrate with state-backed digital money. This creates opportunities for interoperability and compliance-driven innovation.

Expansion of tokenized assets. Real estate, securities, and supply chain tokens are likely to face tailored regulations. Developers who can design compliant tokenization platforms will be in demand.

RegTech and SupTech adoption. Regulators themselves are turning to technology to monitor markets. This will likely lead to stricter data requirements for blockchain platforms, pushing developers to build reporting features directly into applications.

Institutional adoption. As financial institutions embrace crypto ETFs, stablecoins, and security tokens, only projects that meet regulatory standards will gain traction. This raises the bar for what blockchain development companies must deliver.

The future of blockchain will be shaped not just by innovation, but by the ability to align with evolving rules. A blockchain development company that understands these shifts can guide clients through changing requirements and help them scale globally. For stakeholders, this means choosing partners who are not only technically skilled but also forward-looking about compliance.

Final Thoughts

Regulation is shaping blockchain into a more trusted and stable ecosystem. For stakeholders, the challenge is no longer just building technology but building it in line with clear rules. Projects that take compliance seriously will find it easier to scale, attract institutional interest, and create long-term value.

At Codezeros, we align our blockchain development services with this reality. Whether it’s audit-ready smart contracts, compliant token models, or permissioned platforms for regulated industries, we help clients design solutions that are both innovative and regulator-ready.

If you’re planning a blockchain project, reach out to us today.

Frequently Asked Questions

What are the main factors driving global blockchain regulations?

The main drivers are financial crime prevention, investor protection, market stability, and the need for legal clarity as blockchain adoption grows worldwide.

How do regulations affect blockchain development companies?

Regulations push blockchain development companies to design solutions with compliance in mind. This often means integrating KYC/AML features, audit-ready smart contracts, and permissioned frameworks that meet industry rules.

Why are blockchain development services critical in regulated markets?

Businesses rely on blockchain development services to build platforms that not only function well but also satisfy local and global compliance requirements. Without this expertise, projects risk delays, fines, or market restrictions.

How can a project stay compliant with evolving blockchain regulations?

The best approach is to treat compliance as a design principle from the start. Working with an experienced blockchain development company ensures projects can adapt to MiCA, SEC, UAE, and other regulatory frameworks as they evolve.

Post Author

As a distinguished blockchain expert at Codezeros, Paritosh contributes to the company's growth by leveraging his expertise in the field. His forward-thinking mindset and deep industry knowledge position Codezeros at the forefront of blockchain advancements.

Build regulation-ready blockchain solutions with Codezeros to stay compliant in every market.

Our blockchain development experts design audit-ready smart contracts, integrate KYC/AML features, and build permissioned platforms aligned with evolving global laws. We help you launch projects that earn trust, meet compliance, and scale with confidence.