SHARE THIS ARTICLE

NFT-Fi in 2025: The Rise of NFT Collateralization and Perpetual Rentals

A couple of years ago, NFTs were mostly art, avatars, and hype. Collectible, yes. Financially useful? Not really.

Fast forward to 2025, and we’re in a different game. NFTs aren’t just being bought and sold—they’re being staked, rented, and used as collateral. That’s the core of NFT-Fi. It’s where ownership meets liquidity.

This shift didn’t happen on its own. It’s being built by developers who understand what Web3 needs next. NFT development companies like Codezeros are laying the groundwork, turning static assets into programmable value.

NFTs aren’t sitting in wallets anymore. They’re working.

What Is NFT-Fi?

NFT-Fi is short for NFT Finance. It’s where NFTs stop being just collectibles and start behaving like financial assets. At its core, NFT-Fi brings the tools of DeFi—like lending, staking, and liquidity—to NFTs.

So instead of just holding an NFT and hoping it goes up in value, users can now stake it, use it as collateral on NFT lending platforms, or even rent it out for passive income. Some are even splitting NFTs into shares through fractional ownership, letting multiple users co-own and benefit from a single asset.

This isn’t just theory anymore. In 2025, we’re already seeing NFT financialization play out in real ways. Gamers are borrowing against in-game NFTs. DAOs are pooling capital to rent virtual land. Artists are earning a steady income by leasing access to their work.

As DeFi NFT integration improves, more platforms are supporting smart contracts built specifically for these use cases. And that’s what sets NFT-Fi apart—it’s not about hype, it’s about what NFTs can do.

NFT Collateralization: Turning Ownership into Liquidity

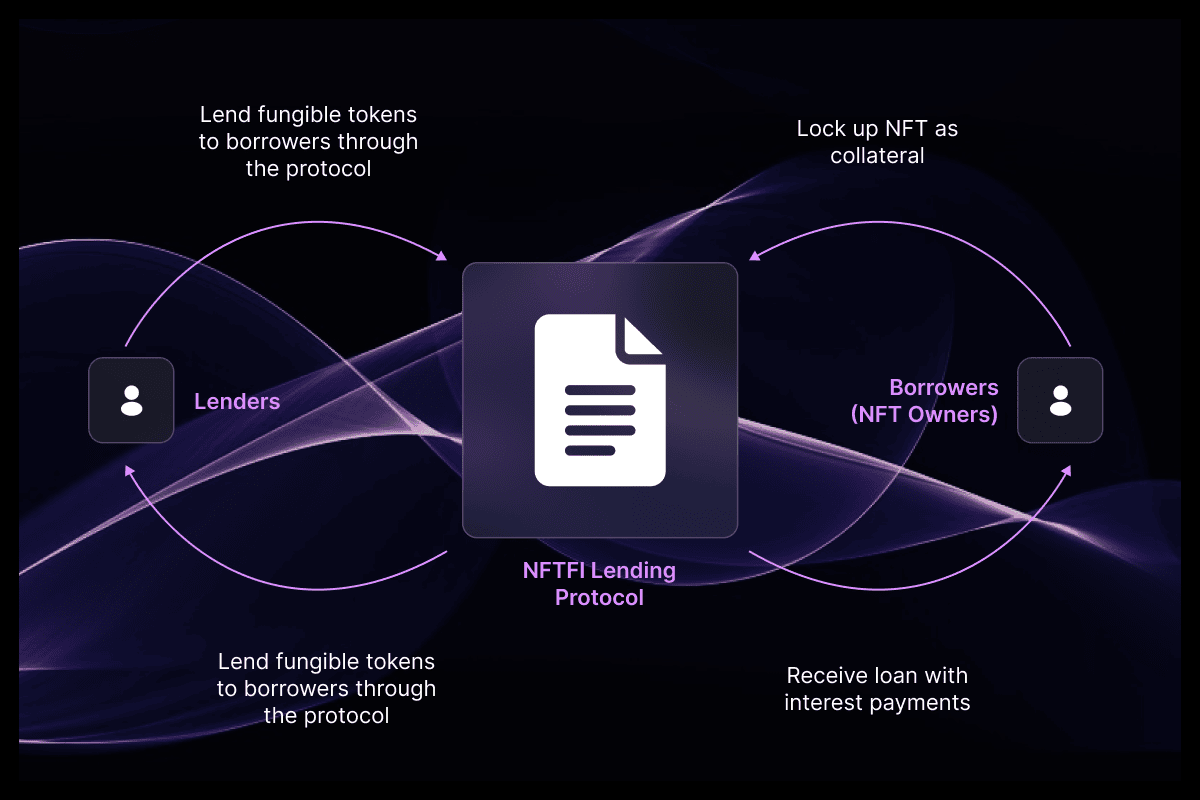

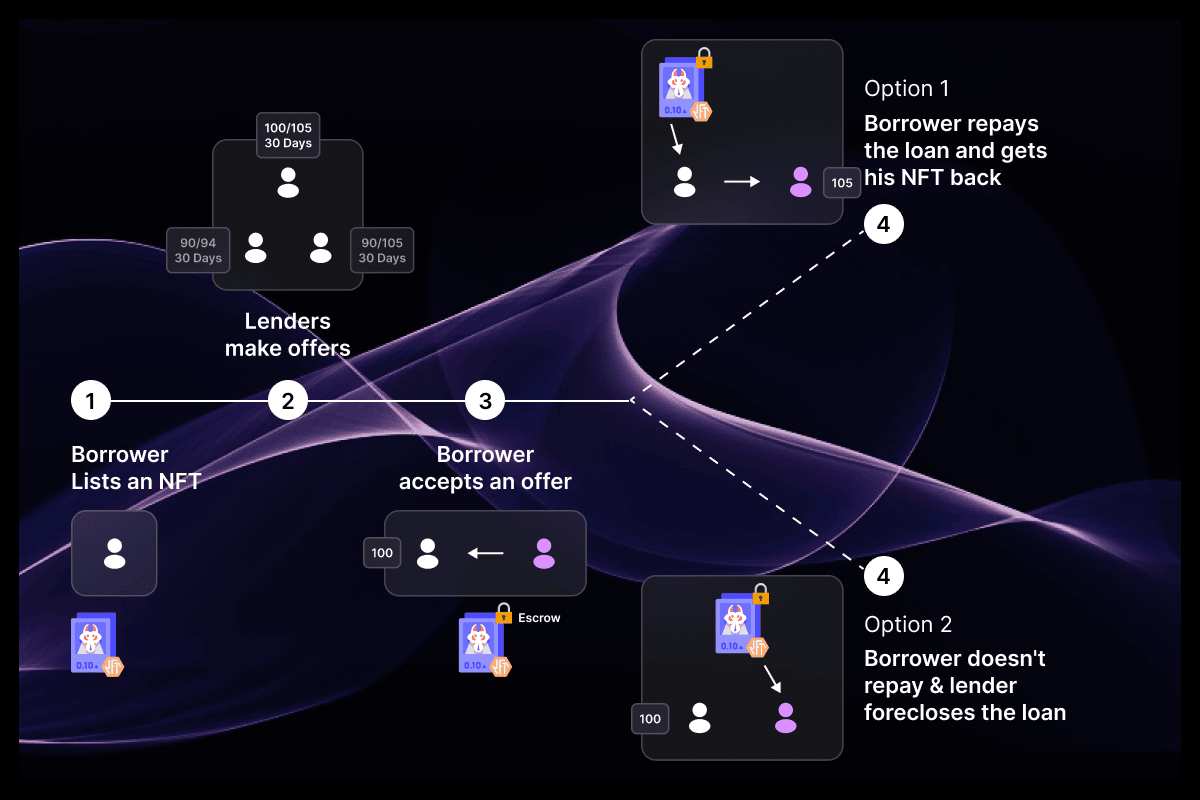

NFT collateralization is simple in theory. Instead of letting your NFTs sit idle, you lock them up as collateral and borrow against them. Just like taking out a loan against a house or car, only this time, it’s a digital collectible or an in-game item.

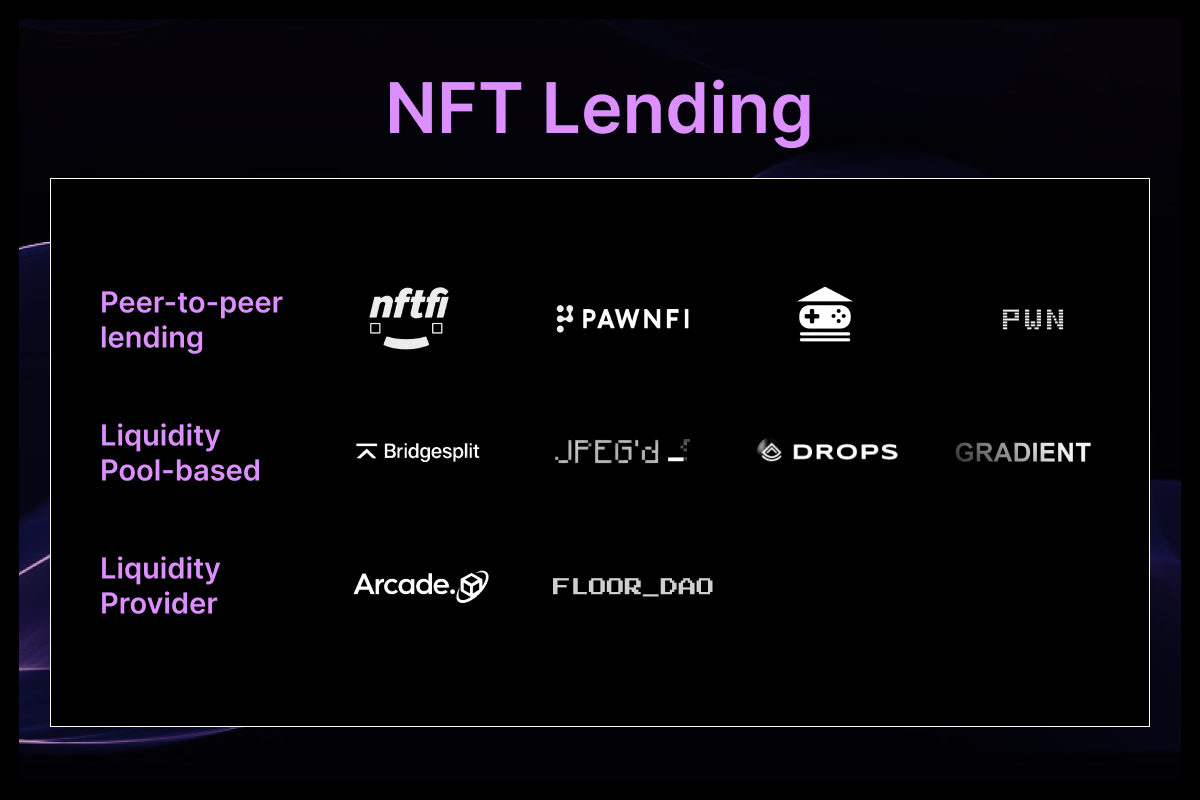

Using NFT as collateral has opened up new ways to unlock liquidity without selling the asset. Platforms offering NFT-backed loans are gaining traction fast. Protocols like Arcade, JPEG’d, and Drops let users lock up blue-chip NFTs like BAYC or Azuki and receive stablecoins in return. New NFT mortgage platforms are even exploring long-term financing models for high-value virtual land and assets.

But it's not risk-free. Unlike fungible tokens, NFT pricing is volatile and subjective. If the value of the NFT drops too far, liquidation can be brutal. There's also the question of how to assess and agree on fair valuation. Different platforms use different models—some rely on oracles, others on curated whitelists or community governance.

Still, NFT collateralization is gaining real momentum. For many holders, it’s a smarter play than selling. For developers, it’s a growing opportunity to build better lending mechanisms and smarter risk systems.

The Rise of Perpetual NFT Rentals

Perpetual renting is one of the most underrated NFT-Fi use cases right now. Instead of buying an NFT outright, users can rent it indefinitely through a smart contract, as long as they keep paying the agreed fee.

NFT perpetual rentals are already being explored across gaming, virtual land, and PFP communities. Think about renting a rare sword in a game, leasing metaverse land for events, or paying monthly to use a PFP that unlocks certain benefits. You get utility without ownership, and the original holder earns passive income without selling the asset.

This model is powered by NFT rental smart contracts. These contracts handle access, enforce terms, and return the NFT if payments stop. There’s no need for middlemen, and terms can be flexible—daily, weekly, monthly, or unlimited.

NFT leasing is also becoming a go-to model for brands and creators. Instead of selling out collections, they rent out access. This opens up low-cost exposure for users who might not afford the full asset, while giving holders more ways to earn.

NFT rental platforms are now popping up to support this trend. ReNFT, Double, and IQ Protocol are a few examples experimenting with different models.

In short, rentals are turning NFTs into yield-generating assets. The upside is clear: more utility, more access, and more cash flow.

New NFT-Fi Infrastructure and Protocols

As NFT-Fi scales in 2025, it’s not just the ideas that are evolving—it’s the infrastructure behind them. A new generation of tools and protocols is being built to handle the complexity of lending, renting, and liquidity around NFTs.

At the core are NFT lending protocols. These platforms are moving beyond basic P2P loans to offer pooled lending, collateral auctions, and dynamic interest models. Some are integrated with oracles to track floor prices. Others use governance to manage which collections are accepted.

On the liquidity side, NFT liquidity solutions are solving the biggest hurdle NFTs have faced—illiquidity. Protocols now allow instant buy-sell mechanisms using AMM-style models or NFT vaults. Some are even experimenting with bonding curves to ensure smoother exits and entries for fractionalized assets.

Behind all this is a major shift in how smart contracts are written. Builders offering smart contract development services are no longer just coding minting logic or basic transfers. They’re developing contracts that support time-bound rentals, escrow-backed lending, liquidation triggers, and DAO-controlled risk parameters.

The NFT-Fi stack is getting deeper and smarter. What started as a few lending platforms is now shaping up into a full ecosystem of permissionless tools ready to plug into any Web3 product.

The Role of NFT Development Companies in Enabling NFT-Fi

None of this works without code. Behind every NFT lending protocol, rental marketplace, or staking vault is a team building the logic that powers it. That’s where NFT development companies step in.

Firms like Codezeros are helping projects move from static collections to fully functional financial platforms. Through NFT development services, they’re building out custom logic for staking rewards, lending mechanics, and perpetual rentals, tailored to whatever the use case demands.

Custom NFT solutions are especially important in this space. One-size-fits-all contracts won’t cut it when you’re dealing with real-time interest rates, multi-party access, or value-based liquidation. Every collection, every platform, every DAO has its own needs. That’s why NFT platform development today is more than UI and mint buttons—it’s about writing contracts that can hold up under pressure.

Security also can’t be an afterthought. With assets on the line, smart contract audits and testing are baked into every serious project. A small flaw in a lending contract or rental escrow can drain funds or break the protocol. Companies that specialize in secure Web3 builds are playing a key role in keeping NFT-Fi stable as it scales.

If NFT-Fi is the future of NFT utility, developers are the ones shaping that future.

Emerging Trends and Predictions for NFT-Fi in 2025

As more users explore NFT utility beyond holding or flipping, new trends in NFT-Fi are starting to define what comes next. 2025 is shaping up to be the year NFT assets go fully financial, across chains, use cases, and ownership models.

One of the biggest shifts is the rise of cross-chain NFT-Fi. Platforms are moving beyond single-chain ecosystems, making it easier to stake, rent, or use NFTs as collateral across multiple blockchains. This unlocks more liquidity and wider access to capital, especially for assets originally tied to niche chains.

Another growing trend is dynamic pricing for NFT collateral. Instead of relying on fixed valuations or manually set floors, newer protocols are using real-time oracles, volatility data, and demand metrics to price NFTs. This makes NFT staking rewards and lending positions more responsive and reduces risk for lenders.

We're also seeing the early versions of DAO-governed NFT rentals and lending. Communities are setting the rules for who can borrow, at what terms, and how risk is managed. This brings a layer of collective decision-making to platforms that were previously centralized or too rigid.

Lastly, there’s growing momentum around integrating NFTs with Real World Assets (RWA). Think of tokenized property deeds or car titles used in NFT lending. In these cases, NFT fractional ownership becomes more relevant than ever, letting multiple users share the value and the responsibility tied to a real asset.

All of these NFT-Fi trends in 2025 point to one thing: utility. NFTs are moving from speculation to infrastructure, and the ones that deliver real, usable value are the ones that will stick around.

How Businesses Can Capitalize on NFT-Fi

NFT-Fi isn’t just for collectors or crypto natives anymore. It’s opening doors for all kinds of businesses—from gaming studios to DeFi platforms to real-world asset issuers—looking to unlock new revenue streams and engage users in smarter ways.

Game studios can use NFT rentals to make rare items more accessible without losing control over their IP. DeFi platforms can tap into new collateral sources by supporting NFT-backed lending. Real estate platforms and physical asset issuers are starting to explore enterprise NFT solutions for tokenizing real-world ownership and plugging it into on-chain finance.

If you're thinking of building in this space, the next step is clear: launch your own NFT rental or lending product. Whether it’s a full protocol, a simple staking tool, or a community-governed vault, the tech is ready. What matters is working with people who know how to build it right.

That’s where partnering with a professional NFT marketplace development company makes a difference. Firms like Codezeros offer hands-on NFT consulting services, from idea validation to architecture to launch. Whether you need audited smart contracts, a custom rental engine, or an entire NFT-Fi layer integrated into your app, the right team can help you go live faster and safer.

NFT-Fi is no longer experimental. For businesses that move early, it’s a serious edge.

Why Codezeros Is the Right Partner for NFT-Fi Projects

Building in NFT-Fi requires more than just minting NFTs or spinning up a frontend. It demands real technical depth, secure smart contracts, and a clear understanding of how finance, gaming, and ownership models intersect on-chain.

Codezeros brings exactly that. As a seasoned blockchain development company, we’ve delivered custom NFT development services across protocols, marketplaces, and staking ecosystems. Whether you're looking to build dynamic rental mechanics, collateral-based lending pools, or tokenized revenue-sharing models, we’ve built them before—and we’re building them now.

We also offer complete NFT integration services to plug new features into your existing ecosystem without a full rebuild. And our dedicated NFT consulting and delivery team helps you move from concept to mainnet with clarity, speed, and confidence.

NFT-Fi is evolving fast. Codezeros is here to build what’s next.

Final Thoughts

NFTs have come a long way—from static images in a wallet to assets that generate income, provide utility, and unlock liquidity. What we’re seeing in NFT-Fi today is just the beginning. The rails are being laid for a more active, financially useful layer of ownership.

As NFT financialization picks up speed, the most impactful projects will be the ones that move early, build strong, and stay flexible.

If you're exploring ideas around lending, rentals, staking, or tokenizing real-world assets, now is the time to build. Partner with an NFT development company that understands both the tech and the vision.

Let’s make your NFTs work smarter.

Post Author

Explore Deep's insightful blog posts that help businesses stay ahead of the curve, explore new possibilities, and unlock the full potential of blockchain technology

Turn NFTs into working capital with Codezeros’ advanced collateralization, leasing, and DeFi integration services.

Our NFT development services support dynamic pricing, secure lending, and perpetual rental models. Build smarter ownership logic with custom smart contracts and full-stack delivery from a proven blockchain development company.

Blogs

Our Latest Blogs

Discover valuable industry insights and stay up-to-date with the latest updates by exploring our curated collection of recent blog posts.

Let us know your requirement

We know ideas matter, we are the product of one. We Provide Full Assistance In Your Business