SHARE THIS ARTICLE

Understanding Spot Ethereum ETFs

The recent approval of Spot Ethereum ETFs by the U.S. Securities and Exchange Commission (SEC) marks a significant milestone in the evolution of the Ethereum ecosystem. This development has sent shockwaves through the cryptocurrency market, as investors and traders alike await the potential impact on the price and liquidity of Ethereum. The approval of these ETFs signifies a major step forward in the mainstream adoption of Ethereum, as it provides a new avenue for institutional investors to gain exposure to the cryptocurrency.

Spot Ethereum ETFs are a type of exchange-traded fund that directly holds and tracks the price of Ethereum (ETH). Unlike traditional ETFs, which often track the price of a futures contract, Spot ETFs provide direct exposure to the underlying asset. This unique characteristic allows investors to benefit from the price movements of Ethereum without the need for complex derivatives.

The approved Spot Ethereum ETFs include:

-

Grayscale Ethereum Trust

-

Bitwise Ethereum ETF

-

Blackrock’s iShares Ethereum Trust

-

VanEck Ethereum Trust

-

ARK 21Shares Ethereum ETF

-

Invesco Galaxy Ethereum ETF

-

Fidelity Ethereum Fund

-

Franklin Ethereum ETF

These ETFs are designed to track the price of Ethereum, providing investors with a diversified and liquid way to gain exposure to the cryptocurrency.

In this article, we’ll explore the intricacies of Spot Ethereum ETFs and their implications for Ethereum application development and the broader blockchain ecosystem. We’ll also walk through the benefits and risks associated with these ETFs, as well as their potential impact on the market and the Ethereum ecosystem.

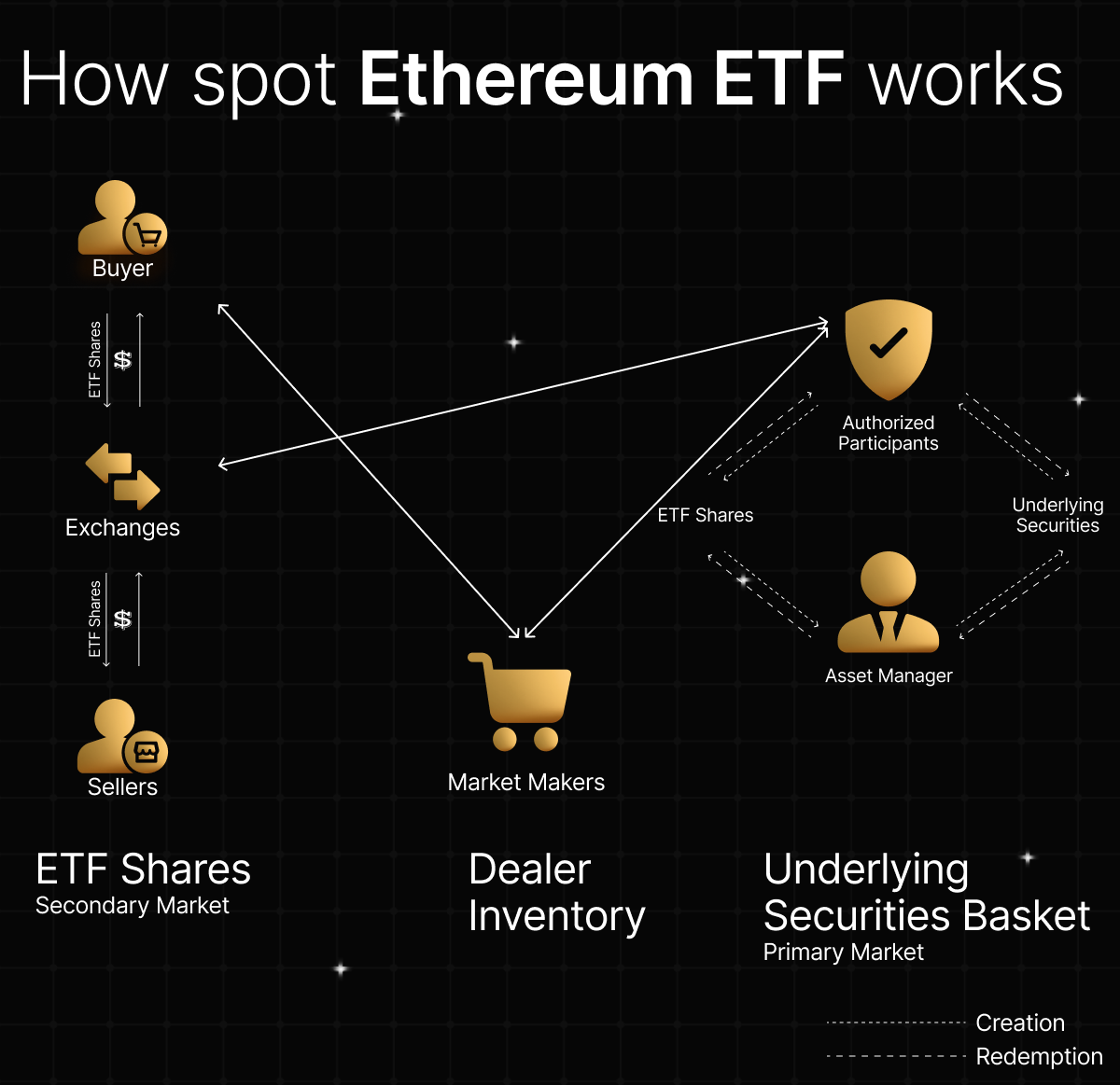

Understanding the Mechanics of Spot Ethereum ETFs

Spot Ethereum ETFs are designed to provide direct exposure to the underlying Ethereum (ETH) tokens, unlike futures-based ETFs that track the price of a futures contract. This direct exposure is achieved through the holding of actual ETH tokens by the ETF. The ETFs will hold these tokens in a secure custodial arrangement, ensuring that the underlying assets are properly protected.

The role of custodians in securing the underlying Ethereum assets is crucial. Custodians are responsible for safely storing and managing the ETH tokens on behalf of the ETF. This involves making sure that the tokens are properly secured, monitored, and audited to prevent any potential theft or loss. The custodian's primary responsibility is to maintain the integrity and security of the underlying assets, thereby protecting the interests of the ETF's investors.

While the custodian plays a vital role in securing the underlying assets, there are potential risks associated with custodian security breaches. In the event of a breach, the ETF's investors could potentially lose their investment. To mitigate these risks, ETFs typically implement effective security measures, such as multi-factor authentication, encryption, and regular audits. Additionally, ETFs often work with reputable and experienced custodians who have a proven track record of securing digital assets.

Benefits of Spot Ethereum ETFs for Ethereum Application Development

The approval of Spot Ethereum ETFs is expected to have a profound impact on the Ethereum ecosystem, especially application development.

Increased Investment and Adoption

By providing a regulated and accessible investment vehicle for Ethereum, Spot ETFs can draw in new investors who may have previously been hesitant to enter the market. This influx of capital can fuel the development of innovative Ethereum-based platforms and applications, driving growth and innovation in the space. This presents a tremendous opportunity for Ethereum application developers to secure funding and bring their visions to life.

Enhanced Market Stability

Spot ETFs can introduce price stability to the Ethereum market. By offering a regulated investment vehicle, ETFs can provide a more predictable investment environment for developers. This stability can be particularly beneficial for developers working on projects built on Ethereum-based platforms, as it allows them to better plan and budget for their projects. With a more stable investment environment, developers can focus on creating innovative applications and platforms, rather than worrying about market volatility.

Improved Liquidity

Spot ETFs can also improve the overall liquidity of Ethereum. By providing a new avenue for investors to gain exposure to Ethereum, ETFs can increase the overall liquidity of the cryptocurrency. This increased liquidity can make it easier for developers to access funds for their projects, allowing them to scale their operations and bring their ideas to life. For instance, organizations looking to hire Ethereum developers can now access a broader pool of funding, allowing them to build more complex and ambitious projects.

Technical Considerations for Spot Ethereum ETFs

As Spot Ethereum ETFs begin to trade, several technical considerations will come into play. One of the most crucial aspects is custody and security. The underlying Ethereum assets backing the ETF must be securely stored to prevent theft or loss. This requires efficient custody solutions that can guarantee the integrity and security of the assets.

There are several custody solutions available, each with its own implications for investors and developers building on Ethereum. For instance, some custodians may offer cold storage solutions, where the assets are stored offline, while others may use hot storage solutions, where the assets are stored online. Investors and developers must carefully evaluate these options to determine which one best suits their needs.

Another technical consideration is tracking error. Tracking error refers to the difference between the performance of the ETF and the actual price of Ethereum. This discrepancy can arise due to various factors, such as custodian fees, expenses associated with managing the ETF, and even the timing of Ethereum purchases and sales by the ETF provider. While tracking errors are typically minimal, they can impact the performance of the ETF, as it may not perfectly track the price of the underlying asset. Investors must be aware of this potential discrepancy and consider it when making investment decisions.

EVM compatibility is also a crucial consideration for developers building applications that interact with the ETF. EVM compatibility makes sure that the ETF can efficiently integrate with existing Ethereum infrastructure, allowing developers to build applications that interact with the ETF without any issues. EVM compatibility is a significant factor for developers building decentralized applications (dApps) that rely on the ETF for funding. Conversely, a non-EVM-compatible Spot ETF might require developers to adopt new tools and approaches, hindering innovation and adoption within the Ethereum developer community.

Potential Challenges and Risks

The onset of Spot Ethereum ETFs is a positive step for the Ethereum ecosystem but it's important to acknowledge some potential challenges and risks.

-

Regulatory Uncertainty

The ongoing regulatory landscape surrounding cryptocurrencies remains fluid, and it may impact Spot Ethereum ETFs in the future. Regulatory changes or clarifications could potentially affect the ETF's structure, fees, or its ability to operate. Furthermore, these regulations might address aspects like custody practices, investor suitability requirements, or even the underlying definition of security. Investors and developers must stay informed about regulatory developments to ensure that their investments and applications are compliant with changing regulations.

-

Market Volatility

The cryptocurrency market is inherently volatile, and this volatility can translate to price fluctuations in the ETF. This means that the price of Ethereum can experience significant fluctuations in short periods, leading to investors experiencing considerable gains or losses depending on market conditions. Developers building applications that interact with the ETF must also be prepared for these fluctuations, as they can impact the stability and performance of their projects.

-

ETF Structure and Fees

Spot ETFs can be structured in two primary ways - physically-backed and synthetic. Physically-backed ETFs hold the actual Ethereum tokens, while synthetic ones utilize derivative contracts to track the price. Understanding the structure of a particular ETF is crucial, as it can impact factors like liquidity and potential tax implications. Moreover, the fees associated with these structures can impact investor returns, with physical ETFs typically having lower fees due to the lack of derivatives. Investors must carefully evaluate these fees and structures to determine which one best suits their investment goals and risk tolerance.

The Impact on Ethereum's Ecosystem and Adoption

The arrival of Spot ETFs can significantly impact the overall adoption and development activity on Ethereum-based platforms. One of the primary effects will be an increase in institutional investment in Ethereum projects and EVM-compatible solutions. Institutional investors, such as pension funds and hedge funds, are often restricted from investing in cryptocurrencies due to regulatory obstacles. The introduction of Spot ETFs provides a regulated and accessible investment vehicle for these institutions, allowing them to gain exposure to Ethereum and its ecosystem.

This increased institutional investment is likely to drive growth and development in the Ethereum ecosystem. As more institutions invest in Ethereum projects, there will be greater demand for EVM-compatible solutions, which will in turn drive innovation and adoption. This can lead to a snowball effect, where increased adoption and investment fuel further growth and development.

However, with an increase in adoption comes the potential for challenges related to scalability and infrastructure. Ethereum's current infrastructure may struggle to handle the increased demand, leading to congestion and slower transaction times. To address this, the Ethereum community will need to continue to develop and improve the network's scalability and infrastructure.

Future Outlook

The approval of Spot ETFs marks a pivotal moment for the Ethereum ecosystem. the impact of Spot Ethereum ETFs is likely to grow and change as the technology matures. Potential future developments might include the introduction of options for fractional shares, allowing investors to participate with smaller amounts. Additionally, the integration of DeFi protocols within Spot ETF structures could further streamline the investment process.

One thing remains certain - Spot ETFs can lead to exciting possibilities for both investors and developers within the Ethereum space. Investors now have a more accessible way to gain exposure to Ethereum, potentially benefiting from its long-term growth prospects. Developers, on the other hand, can leverage this rise in investment and adoption to build innovative applications and propel the Ethereum ecosystem forward.

At Codezeros, we are thrilled to be a part of this dynamic and rapidly evolving ecosystem. Our team of experienced Ethereum developers is well-equipped to help you build innovative decentralized applications (dApps) and harness EVM-compatible solutions. Let's connect and explore the exciting opportunities that Spot ETFs and the Ethereum ecosystem present.

Post Author

Explore Deep's insightful blog posts that help businesses stay ahead of the curve, explore new possibilities, and unlock the full potential of blockchain technology

Learn how Spot ETFs can fuel development and help you to build innovative applications on Ethereum.

Spot ETFs are igniting a surge in Ethereum adoption. At Codezeros, we bridge the gap between investment and development. We can provide you with the expert guidance you need to build on the Ethereum platform.