SHARE THIS ARTICLE

How to Design Token Incentives That Don’t Implode by Week Three

The Web3 space is flooded with new tokens every month. Yet many projects collapse within weeks of launch. Studies show that more than 1.8 million tokens created in the past year were abandoned within their first three months due to broken models and poor planning.

The root cause is rarely technology. Most failures happen because of a flawed tokenomics design. Founders set unsustainable emission rates, neglect token sinks, or rely on hype-driven incentive schemes that quickly unravel. Once early users dump their allocations and no meaningful demand remains, the token price collapses.

This blog showcases how to avoid that fate. We will cover token incentive design, identify common pitfalls, highlight tokenomics best practices, and share strategies like dynamic token emissions, token sinks, and the ve(3,3) model. We will also explain why tokenomics simulation and professional support from a blockchain development company can make the difference between collapse and sustainable growth.

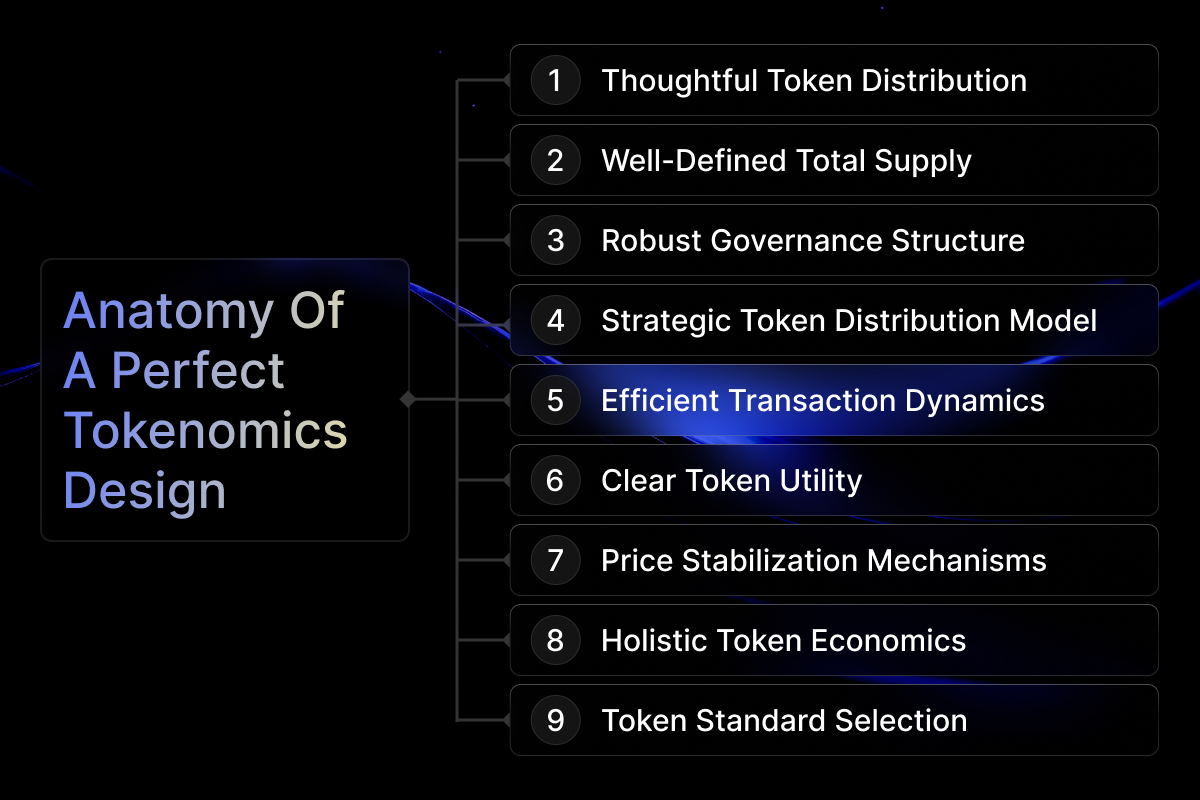

The Anatomy of Token Incentives

At its core, a token incentive is a structured reward system that drives desired behavior in a blockchain ecosystem. For Web3 startups, incentives often include:

-

Staking rewards for liquidity providers

-

Governance rights for active participants

-

Access to products or exclusive utilities

-

Yield or farming opportunities for token holders

When designed well, these incentives align user activity with long-term value creation. When poorly designed, they lead to inflation, short-term speculation, and project abandonment.

This makes tokenomics design a critical step in launching any protocol.

Common Pitfalls in Token Incentive Design

Over-aggressive Emissions and Hyperinflation

Many projects release too many tokens too quickly. Without sufficient demand, this causes token hyperinflation. Prices spiral down, and holders lose confidence. Early adopters exit, leaving the project with a shrinking community.

Shallow Token Sinks

A token sink is any mechanism that removes tokens from circulation. If sinks are weak or absent, supply keeps rising while demand stays flat. Common shallow sinks include minor burn fees or negligible staking rewards. Without real sinks, tokens lose utility and value.

Poor Vesting and Unlock Schedules

Investor or team tokens often unlock too soon, creating sell pressure. Without carefully planned token vesting schedules, the market is flooded. Retail participants feel dumped on, damaging community trust.

One-Size-Fits-All Models

Using the same model across different ecosystems rarely works. Every project needs tailored tokenomics best practices suited to its goals, user base, and product. Copy-pasting emissions or staking rates from another project often ends in failure.

Best Practices for Sustainable Tokenomics

Designing resilient incentives means balancing rewards, sinks, and governance. Let’s look at proven strategies.

Controlled and Dynamic Token Emissions

Tokens should not be released at a fixed, unsustainable pace. Instead, use dynamic token emissions that adjust based on demand and activity.

Examples include:

-

Reducing emissions as user adoption stabilizes

-

Adjusting emissions algorithmically if the token price falls below a threshold

-

Increasing rewards during key adoption phases and tapering later

By linking emissions to measurable network activity, projects can avoid oversupply.

Designing Strong Token Sinks

Every sustainable model needs effective token sinks. These give holders reasons to keep or lock tokens instead of selling. Examples include:

-

Burn mechanisms: permanently remove tokens from supply

-

Staking rewards: lock tokens for yield and governance power

-

Redemption sinks: allow tokens to be redeemed for discounts, services, or stable assets

-

Utility-driven sinks: require tokens for fees, in-game assets, or access passes

When combined, these sinks create continuous demand and help maintain token scarcity.

Aligning Governance with Long-Term Value

Governance should encourage long-term holding and participation. The ve(3,3) model is a strong example. It blends vote-escrowed tokens (veTokens) with game theory principles from Olympus DAO’s (3,3) design.

In this model, holders lock tokens for longer durations to receive more governance power and higher rewards. The longer the lock, the stronger the influence. This approach incentivizes loyalty and reduces short-term speculation.

Simulation Before Launch

Launching without testing is like flying blind. Tokenomics simulation allows founders to model various market conditions and adoption rates. By stress-testing, they can see how emissions, sinks, and governance mechanisms hold up under different scenarios.

Simulation highlights weaknesses before real capital is at risk. It also allows teams to adjust parameters such as vesting schedules, reward rates, or redemption mechanisms.

Real-World Lessons from Protocols

Axie Infinity’s SLP hyperinflation

Axie Infinity’s play-to-earn model collapsed because its SLP token had insufficient sinks. Players earned far more tokens than were burned in breeding costs. With unlimited emissions and limited sinks, the token lost almost all its value within a year.

Curve Finance and veCRV

Curve pioneered the veToken model. By requiring long-term token locks for governance power, Curve created sticky holders. This design reduced sell pressure and aligned incentives, making CRV one of the most resilient governance tokens in DeFi.

Solidly’s Short-Lived Experiment

Solidly introduced the ve(3,3) model but collapsed within months due to rushed emissions and poor distribution. The lesson is that even advanced models need balanced execution and careful simulation.

These case studies show that sustainable tokenomics comes from combining multiple levers rather than relying on one.

Simulation and Testing - A Non-Negotiable Step

Before launching, every team should simulate:

-

How many tokens will be circulating after week one, two, and three

-

The effect of emissions on price under different adoption rates

-

The impact of unlocks from team or investor wallets

-

Stress tests for demand shocks

Tools and frameworks vary, but the principle is clear: tokenomics simulation saves projects from costly missteps.

Projects that skip this stage often become part of the statistics of tokens that implode before finding real traction.

The Role of Expert Support in Getting Tokenomics Right

Even with strong models, execution requires precision. This is where professional help matters. A blockchain development company with tokenomics expertise can guide teams through:

-

Emission modeling

-

Sink design and integration

-

Governance frameworks like ve(3,3)

-

Simulation of token economies

-

Smart contract implementation

At Codezeros, we provide blockchain development services tailored for protocol founders and Web3 startups. Our experience in designing and deploying sustainable token models helps projects avoid common traps and launch with confidence.

Conclusion

Most token failures are not accidents. They are the result of rushed token incentive design, unchecked emissions, and missing sinks. To avoid collapse, founders must:

-

Control and adapt emissions with dynamic token emissions

-

Create strong token sinks that build lasting demand

-

Use governance models like the ve(3,3) model

-

Run tokenomics simulation before launch

-

Follow proven tokenomics best practices

If you are building a new protocol, the time to design sustainable incentives is now. Partner with Codezeros, a leading blockchain development company, to structure, test, and launch a model that lasts beyond week three. Explore our blockchain development services to see how we can help you transform tokenomics from a liability into a growth engine.

Frequently Asked Questions

Why do most token economies collapse within the first month?

Most tokens fail due to poorly planned emissions, missing token sinks, and early investor unlocks. When supply grows faster than demand, price collapses, and user confidence vanishes. Sustainable tokenomics prevents this.

What is the difference between token emissions and token sinks?

Token emissions are how new tokens enter circulation, while token sinks are mechanisms that remove tokens, such as burning, staking, or redemption. A healthy balance between emissions and sinks keeps supply and demand stable.

How can dynamic token emissions stop hyperinflation?

Dynamic emissions adjust token release based on market activity or demand. By lowering emissions during slow adoption and scaling rewards only when activity grows, projects avoid oversupply and reduce hyperinflation risks.

What is the ve(3,3) model in tokenomics?

The ve(3,3) model combines vote-escrowed governance tokens (veTokens) with cooperative game theory. Holders lock tokens for longer periods to gain more governance power and rewards, which discourages dumping and aligns incentives for long-term value.

What are examples of token sinks that actually work?

Effective token sinks include:

-

Burning tokens permanently

-

Locking tokens for staking rewards

-

Redemption sinks (redeem for stable assets or services)

-

Utility sinks like transaction fees or in-game purchases

How can Web3 startups test their tokenomics before launch?

Web3 startups can run tokenomics simulations to model different adoption rates, emission schedules, and sink scenarios. This helps identify weak points and adjust parameters before real users and capital are involved.

Post Author

As a distinguished blockchain expert at Codezeros, Paritosh contributes to the company's growth by leveraging his expertise in the field. His forward-thinking mindset and deep industry knowledge position Codezeros at the forefront of blockchain advancements.

Design sustainable tokenomics with Codezeros to prevent hyperinflation, shallow sinks, and broken incentive loops.

Our blockchain development experts model dynamic emissions, create effective token sinks, and run simulations before launch. We ensure your protocol’s token economy is designed for long-term adoption and resilience, not short-term collapse.

Blogs

Our Latest Blogs

Discover valuable industry insights and stay up-to-date with the latest updates by exploring our curated collection of recent blog posts.

Let us know your requirement

We know ideas matter, we are the product of one. We Provide Full Assistance In Your Business