SHARE THIS ARTICLE

What is Jito? How It Simplifies Liquid Staking on Solana

Solana is one of the most promising and performant blockchains in the industry. Though it is known for its rapid growth and innovation, Solana is not without its challenges. Staking opportunity costs, security risks on centralized exchanges, and inefficiencies in the mempool are some of the hurdles faced by this high-performance blockchain. Enter Jito, a liquid staking and maximum extractable value (MEV) protocol for the Solana network that aims to address these issues, enhance Solana development services, and provide a better experience for Solana users.

Jito mirrors the success of platforms like Lido on Ethereum and the buzz around Jito escalated when it distributed one of the most lucrative airdrops of the year in December 2023. It offered its native JTO tokens to JitoSOL holders, Solana validators utilizing Jito Solana’s MEV clients, and users of Jito’s MEV services. This move injected new vitality into Solana’s ecosystem, evident in the exponential surge in total value locked (TVL) as more users were introduced to Jito.

This blog is your comprehensive guide – from exploring the basics of Jito as a liquid staking protocol to exploring the tokenomics and utility of JTO tokens, helping you understand the essence of Jito and the excitement brewing around the potential trade of JTO.

What is Jito?

Jito operates as a liquid staking protocol on Solana, utilizing a stake pool model. A stake pool comprises one or more validator nodes. When users deposit their SOL tokens with Jito, they effectively delegate their tokens to the stake pool. In return, users receive Jito Staked SOL (JitoSOL), a liquid stake pool token. JitoSOL represents ownership of the underlying SOL tokens and the staking rewards generated by the stake pool.

What sets Jito apart is the flexibility it offers to users. They can freely trade, transfer, or use their JitoSOL tokens in various DeFi protocols, including lending, borrowing, or yield farming, all without sacrificing their staking position or rewards. Additionally, Jito introduces users to the concept of Maximum Extractable Value (MEV), which represents the extra profit achievable by manipulating transaction order or inclusion on the blockchain. Jito employs MEV strategies to enhance the returns of the stake pool, sharing these benefits with JitoSOL holders.

In essence, Jito combines the power of liquid staking, DeFi flexibility, and MEV advantages to provide a comprehensive and rewarding staking experience on the Solana network.

Jito’s stake pool consists of 163 validators who collectively stake over 6.5 million SOL tokens. Jito chooses these validators based on a set of standards that ensure they:

-

Use a client that supports MEV

-

Participate in more than 80% of the valid blocks in a given period

-

Charge less than 10% commission for both regular and MEV rewards

-

Have less than a 10% delinquency rate during the same period

-

Do not belong to a small group of dominant validators

-

Do not run any risky or harmful consensus changes

-

Stake to only one validator operator at a time

These standards align with Jito’s objectives, which are mainly to back up high-quality validators and enhance decentralization in the Solana network.

What is liquid staking?

Liquid staking, also referred to as "soft staking," involves locking up funds to earn rewards while retaining access to those funds. In contrast to proof-of-stake (PoS) staking, where funds are locked within a protocol, liquid staking keeps the funds accessible in an escrow. When participating in liquid staking, platforms issue separate tokens to the staker, acting as a receipt for their stake. These tokens, known as Liquid Staking Tokens (LSTs) or Liquid Staking Derivatives (LSDs), are pegged to the value of the initial asset. The unique aspect of LSTs or LSDs is their versatility – they can be used as collateral, traded, or transferred on various platforms, introducing new possibilities for liquidity and composability within the DeFi ecosystem.

What is MEV?

MEV, short for Maximum Extractable Value, refers to the intentional rearrangement, addition, or exclusion of transactions during the creation of a new block for blockchain inclusion. The primary goal is to maximize profits. Various participants, including miners, validators, arbitrageurs, or front-runners, can generate MEV by taking advantage of market inefficiencies, network congestion, or information disparities. While MEV can lead to negative outcomes like higher gas fees, diminished security, and unfair results for users, it can also serve positive purposes such as enhancing network efficiency, curbing spam, and providing incentives for staking.

How Jito Boosts Staking Yield with MEV

Jito addresses the challenges posed by MEV with its innovative product suite, consisting of three primary components.

Jito-Solana Validator Client: A modified version of the Solana validator software that enables MEV extraction and redistribution.

Jito Labs Block Engine: A smart contract that conducts an auction for every block, where MEV searchers submit bids for profitable transaction sequences. The Block Engine then selects the optimal combination of transactions that maximizes the rewards for the validator and the stakers.

Jito Relayer: A server that filters and verifies bids from MEV searchers and submits them to the Block Engine and the validator.

By using Jito’s product suite, validators and stakers can capture the MEV generated on the Solana network and share the profits. Jito stakers, and therefore JitoSOL holders, receive a portion of the MEV proceeds in addition to the staking rewards. This way, Jito enhances the staking yield for SOL holders and helps decentralize the Solana network by spreading the stake across the network.

How Jito Works

With its innovative approach, Jito opens up a myriad of possibilities within the DeFi ecosystem. Here’s an insight into the intricate workings of this dynamic liquid staking protocol on Solana.

Staking SOL and receiving JitoSOL

To stake with Jito, users need to have a Solana wallet, such as Phantom or Sollet, and connect to the Jito website. Users can choose the amount of SOL they want to stake and deposit it into the Jito stake pool. Against the amount of SOL staked, the users receive an equivalent amount of JitoSOL tokens, which are minted by the Jito smart contract and sent to the user’s wallet. The exchange rate between SOL and JitoSOL is steadfast at 1:1, meaning one JitoSOL token is perpetually valued at one SOL token. The user-friendly Jito dashboard makes it pretty straightforward for users to monitor their staking performance, rewards, and statistics.

Delegating SOL to MEV-enabled validators

The Jito stake pool delegates staked SOL to MEV-enabled validators, equipped with a modified Solana client supporting MEV extraction. Maximum Extractable Value (MEV) is the profit derived from strategic transaction reordering, insertion, or censorship. MEV-enabled validators orchestrate auctions for available blockspace, which allows the highest bidder to execute their MEV strategy and receive corresponding rewards.

Redistributing MEV Rewards to the Stake Pool

MEV rewards that the validators receive are not just their own; they flow back into the Jito stake pool as an extra Annual Percentage Yield (APY). This additional APY contributes to the returns earned by JitoSOL holders. This ensures they benefit from both regular staking rewards and MEV rewards. The Jito stake pool charges a nominal fee for its service, which serves to cover operational costs and fund protocol development.

Trading, Lending, or Borrowing JitoSOL

JitoSOL tokens, being ERC-20 compatible, open up a myriad of opportunities on various DeFi platforms like Serum, Raydium, Saber, and Solend. JitoSOL holders can freely trade, lend, or borrow their tokens, providing liquidity, and engaging in yield farming. This flexibility allows users to utilize their staked SOL for trading, lending, borrowing, or yield farming while retaining the option to convert JitoSOL back to SOL at their convenience.

What is JTO, Its Use Cases, and Its Tokenomics?

JTO is the governance token of the Jito protocol which allows users to participate in the Jito DAO and vote on all future critical decisions that affect the protocol and products. This includes key operational and strategic decisions, such as setting fees, updating delegation strategies, managing the treasury, and contributing to the development and improvement of the protocol and products. This ensures a decentralized, transparent, and community-driven approach to governance.

JTO Use Cases

JTO tokens can be used for various purposes, such as:

-

MEV shareholding: JTO token holders can enjoy a share of the MEV revenue captured by the Jito Block Engine, which optimizes the ordering and execution of transactions on the Solana blockchain.

-

Community access: JTO token holders can access exclusive Jito community events, airdrops, and early access to exciting new features, and connect with other like-minded Jito enthusiasts.

-

DeFi: JTO token holders can use their tokens in various DeFi protocols, such as trading, lending, borrowing, yield farming, or providing liquidity, and benefit from the liquidity and composability of the Solana ecosystem.

-

Potential future staking pools: JTO token holders may have the opportunity to join special JTO-only staking pools with potentially higher rewards in the future, although this has not been officially announced yet.

-

Potential future staking multiplier: JTO token holders may have the chance to boost their JitoSOL staking rewards by holding JTO tokens in the future, although this is still under development and details have not been finalized yet.

An Insight into JTO Tokenomics

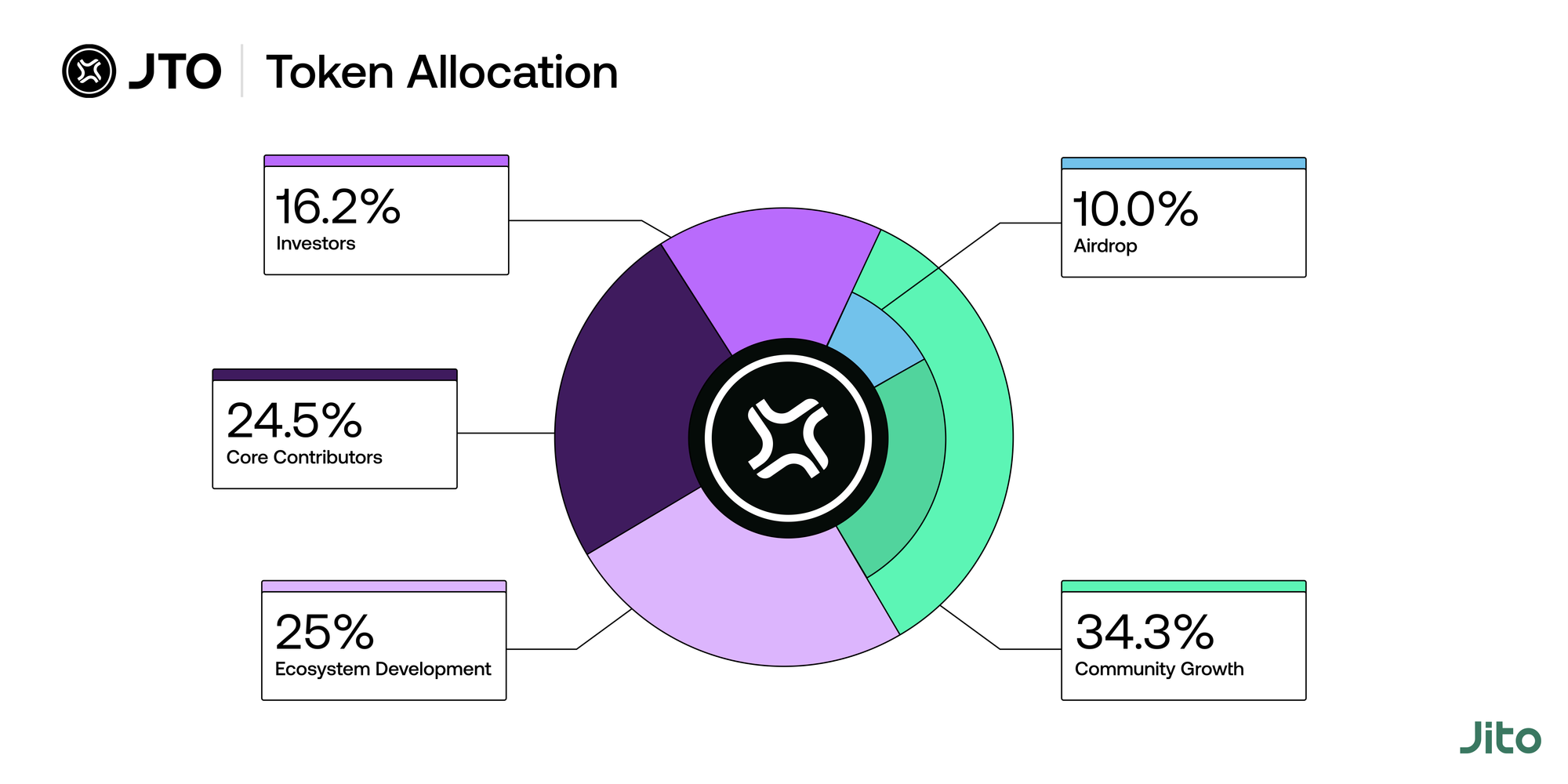

The total supply of JTO tokens is 1 billion, of which 120 million are currently circulating. The token distribution is as follows:

-

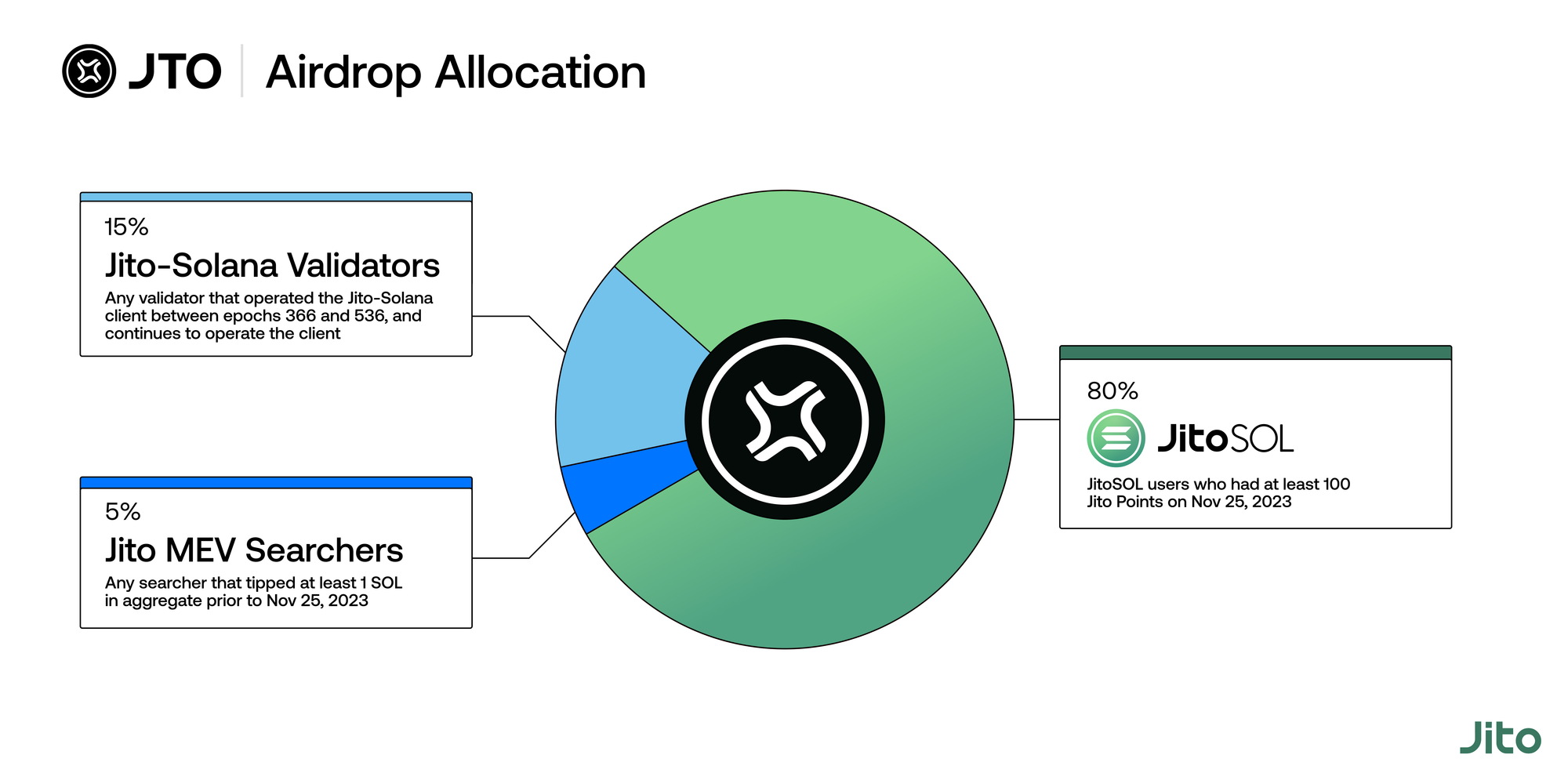

10% for the airdrop, which was distributed to JitoSOL holders, Solana validators who used Jito Solana’s MEV clients, and users of Jito’s MEV services.

-

34% for community growth, which will be used to incentivize the adoption and development of the Jito protocol and products.

-

20% for the team and advisors, which will be vested over 4 years with a 1-year cliff.

-

15% for the foundation, which will be used to fund the research and innovation of the Jito protocol and products.

-

10% for the ecosystem, which will be used to support the integration and collaboration of the Jito protocol and products with other DeFi platforms and projects.

-

6% for the seed sale, which was sold to early investors at $0.05 per token with a 12-month vesting period.

-

5% for the private sale, which was sold to strategic investors at $0.1 per token with a 6-month vesting period.

Source: https://www.jito.network/blog/announcing-jto-the-jito-governance-token/

JTO Airdrop

JitoSOL holders were eligible for the JTO airdrop based on the point system that Jito introduced in September 2023. However, the points started to accumulate from the beginning of 2023, with one point earned per day for each JitoSOL token held. Jito divided the users into 10 tiers according to their points, with the lowest tier getting 4,941 JTO and the highest tier getting 104,391 JTO.

The JTO airdrop was designed to reward the smaller wallets more than the larger ones, creating a fairer and more inclusive distribution. The users welcomed this move and appreciated the generosity of Jito towards the smaller players in the DeFi space.

The JTO airdrop claim window is now open on the Jito website and will last for 18 months until June 7, 2025. Users can easily connect their wallets to the website and check if they are eligible and claim their JTO tokens.

Source: https://www.jito.network/blog/jto-airdrop-eligibility-and-allocation-specifications/

The Road Ahead for Jito

Since its launch, Jito has already achieved some impressive milestones. However, Jito is not resting on its laurels and has an ambitious roadmap for the future.

-

Expanding the DeFi integration - to connect and bridge with more DeFi protocols, giving users and Solana developers more options and opportunities to use their JitoSOL tokens.

-

Refining the MEV optimization strategies – to involve continuous research and development efforts to improve Jito’s MEV capture methods, increasing the returns for stakers.

-

Driving the community growth – to entail releasing more JTO tokens and distributing more rewards to encourage engagement and feedback among Jito community members.

-

Developing the ecosystem – to include creating other potential products that can run on the Solana blockchain, such as the StakeNet protocol, a decentralized Solana stake pool manager that offers secure and transparent validator management, and autonomous stake operations.

Jito is committed to creating a mutually beneficial system where everyone can gain from Solana ecosystem inefficiencies and enjoy the benefits of liquid staking and MEV. It is dedicated to supporting the Solana network and enhancing its security, efficiency, and decentralization.

Wrapping It Up

When it comes to DeFi and cryptocurrency, Jito stands out as a catalyst for change within the vibrant Solana ecosystem. It invites users to stake their assets, trade on various DeFi platforms, and join a community that shapes the future of Solana. TL;DR, Jito is more than a protocol; it is a dynamic force driven by its community members.

Jito envisions a decentralized future where everyone can benefit from liquid staking and MEV strategies. It aims to create a more accessible, transparent, and rewarding financial landscape on the Solana blockchain.

In this vision, stakeholders, from experts to beginners, collaborate to create a decentralized ecosystem that enhances the Solana network’s efficiency, security, and decentralization. As we look ahead, the Solana ecosystem, supported by the Jito community, offers a future where liquid staking and MEV are available to everyone, marking a major advancement in decentralized finance.

If you want to learn more about Jito and how it can help you leverage the power of Solana, at Codezeros, we can help. As a leading Solana development company, we can assist you in infusing your Solana project with desired functionalities and unparalleled innovation. Get in touch today!

Post Author

Vivek is a passionate writer and technology enthusiast with expertise in blockchain development. As the lead writer for Codezeros, he aims to educate and inform readers about the potential of blockchain technology and simplify complex concepts to present them in an engaging manner for both technical and non-technical readers.

Build your next DeFi dApp on Solana - one of the most promising blockchains.

Solana is becoming increasingly popular owing to its fast performance, low gas fees, and innovative protocols like Jito. If you want to leverage it for your next dApp, at Codezeros, we can help.