SHARE THIS ARTICLE

What is Identity Verification and Why It Matters for Tokenizing Real-World Assets

What if you could turn your house into tradeable tokens, own a fraction of an invaluable art masterpiece, or secure loans against your car – all within a vibrant digital marketplace? This isn’t science fiction; it’s Real-World Asset (RWA) Tokenization, wherein one can transform physical assets into blockchain-based tokens, opening up a world of exciting possibilities.

But amidst the excitement, a critical question arises: who participates in this revolution? That’s where identity verification comes in, ensuring trust and security. With traditional finance, verifying identities is crucial to combat fraud, prevent money laundering, and comply with regulations. Similarly, with RWA tokenization, it plays an even more critical role.

Why? Because when you tokenize assets, you’re essentially digitizing ownership, making it accessible to anyone online. This opens doors to increased liquidity, global reach, and fractional ownership. However, it also exposes potential vulnerabilities. Without robust identity verification, bad actors could exploit the system, jeopardizing the entire ecosystem.

So, in this blog, we learn about the intricacies of identity verification and its impact on RWA tokenization, along with exploring different verification methods, discussing the challenges and opportunities, and understanding how its importance for a secure and prosperous future of tokenized assets.

Understanding Identity Verification in Tokenization

Before we get into the nitty-gritty of things, let’s first dissect the different types of regulatory requirements for identity verification employed in tokenization development services.

-

KYC (Know Your Customer): This is the foundation, requiring platforms to collect and verify basic user information like name, address, and date of birth.

-

AML (Anti-Money Laundering): Going beyond simple identity checks, AML focuses on preventing illegal activities like money laundering and terrorist financing. Platforms need to implement specific measures like source-of-funds checks and transaction monitoring.

Tokenization platforms leverage KYC/AML to verify user identities, prevent fraudulent activity, and comply with legal requirements.

-

KYB (Know Your Business): Similar to KYC, but for businesses that want to participate in tokenized asset markets, requiring verification of company details, ownership structures, and regulatory compliance.

-

Transaction Monitoring: This continuous process analyzes user behavior and transactions for suspicious activity, identifying potential fraud or money laundering attempts before they occur.

-

Enhanced Due Diligence (EDD): When dealing with high-risk individuals or businesses, platforms may require additional verification steps beyond standard KYC/AML checks. This ensures a more thorough assessment of potential risks.

There are additional layers depending on the platform and specific assets, such as KYT (Know Your Transaction) for analyzing individual transactions for suspicious activity.

Technical Mechanisms Behind Identity Verification

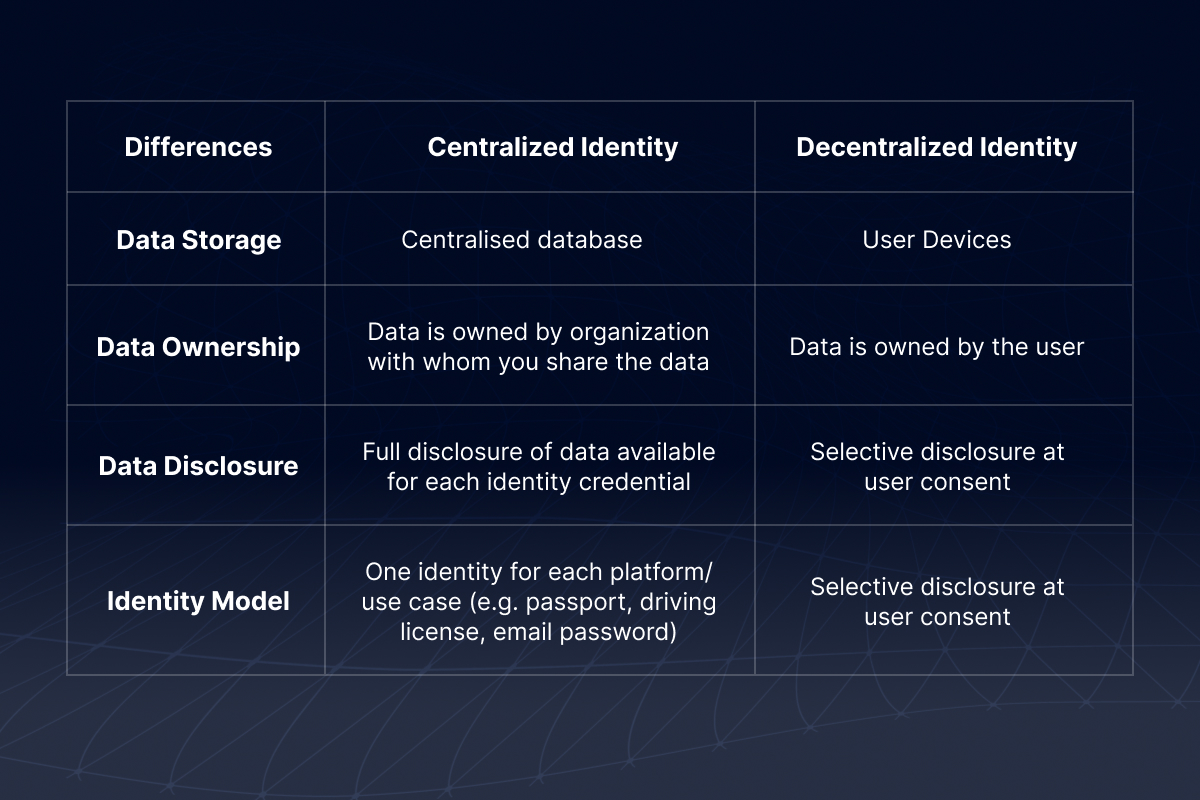

Identity verification in tokenization platforms relies on a combination of centralized and decentralized technical mechanisms:

Centralized Approaches: Many platforms rely on centralized verification services, which access and verify user information against government databases or other trusted sources. This approach offers efficiency and regulatory compliance but raises concerns about data privacy and potential single points of failure.

Decentralized Approaches: The implementation of blockchain in digital identity solutions is increasing, aiming to provide users with control over their identity data. These approaches utilize decentralized identity (DID) protocols, where users store and manage their own credentials on the blockchain, sharing only necessary information with platforms. This fosters greater privacy and security but requires robust technical infrastructure and wider adoption.

Balancing Security with User Privacy

While robust identity verification is essential for security, striking a balance with user privacy remains a crucial challenge. Users understandably want to protect their personal information, while platforms need enough data to ensure compliance and prevent fraud. This delicate balance requires innovative solutions like:

-

Privacy-Preserving Technologies: Tokenization platforms are increasingly exploring privacy-preserving technologies such as zero-knowledge proofs and homomorphic encryption to provide secure identity verification without exposing sensitive user data. These technologies allow verification to be performed on encrypted data without revealing the underlying information, improving privacy while maintaining security.

-

Transparency and Consent: Platforms must prioritize transparency and obtain user consent regarding the collection and usage of their personal information for identity verification purposes. Implementing clear privacy policies, providing users with control over their data, and obtaining explicit consent for data processing are essential steps in addressing privacy concerns.

Why Identity Verification Matters

In a thriving tokenized marketplace without an optimal identity verification setup, anyone can participate freely, regardless of identity or intent. Such a scenario would open doors to a hoard of potential risks.

Fraudulent Activity: Unverified users could easily create fake identities, inflate asset values through pump-and-dump schemes, and engage in insider trading, eroding trust and manipulating the market.

Money Laundering: Tokenization can inadvertently become a haven for money laundering if bad actors exploit anonymity to disguise the illicit origins of funds. This not only undermines the integrity of the ecosystem but also poses significant legal and reputational risks.

Regulatory Backlash: Inadequate identity verification can trigger regulatory scrutiny and potential sanctions. Governments have a vested interest in preventing financial crime, and non-compliance with KYC/AML and other regulations could jeopardize the entire tokenization industry.

Beyond the immediate risks, the absence of robust identity verification weakens the very foundation of tokenized assets: trust and transparency. Investors need to be confident that they are transacting with legitimate individuals and businesses, and that the underlying assets are truly what they claim to be. Without this trust, the entire ecosystem becomes fragile and susceptible to collapse.

However, a brighter side exists. Utilizing robust identity verification offers numerous benefits:

Building Trust and Transparency: By verifying identities, platforms can create a more transparent and trustworthy environment for investors. This boosts confidence, attracts new participants, and ultimately fuels the growth of the tokenized asset market.

Better Investor Protection: Strong identity verification helps protect investors from fraudulent activities and market manipulation, ensuring a fairer and safer trading environment.

Facilitating Regulatory Compliance: Implementing industry-standard verification procedures demonstrates a commitment to compliance, mitigating legal risks and paving the way for wider adoption.

Unlocking New Features and Functionalities: Verified identities can offer advanced features like access control based on specific criteria, opening up innovative investment opportunities and catering to diverse user needs.

Addressing Regulatory Concerns

It's important to acknowledge that identity verification requirements vary across jurisdictions. Platforms need to stay informed about evolving regulations and implement procedures that comply with relevant laws in their target markets. Additionally, industry-wide collaboration towards standardized identity verification frameworks can further increase trust, transparency, and interoperability.

By actively addressing the risks and tapping into the benefits of robust identity verification, we can build a stronger foundation for the future of tokenized assets. With trust, transparency, and regulatory compliance in place, we can take full advantage of this revolutionary technology and create a secure, thriving ecosystem for all participants.

Benefits of Secure Identity Verification in RWA Tokenization

Building a secure and progressive tokenized ecosystem requires more than just mitigating risks. Robust identity verification offers a myriad of benefits that fuel growth, innovation, and trust within the RWA tokenization domain.

Increased Market Access and Liquidity

Traditional asset ownership often restricts participation due to high investment thresholds and geographic limitations. Tokenization fragments ownership, making assets more accessible and divisible. When coupled with secure identity verification, it opens doors to a wider pool of investors, boosting liquidity and opening up the true potential of tokenized assets. Moreover, verified participants can diversify their portfolios with unique tokenized assets and take advantage of new investment opportunities.

Reduced Risk of Fraud and Illegal Activity

Inadequate verification creates fertile ground for fraudulent activity. Secure identity verification acts as a formidable shield, filtering out bad actors and preventing fraudulent schemes and money laundering. This creates a safer and more reliable environment for legitimate investors and businesses, leading to long-term growth and stability.

Improved Compliance

The tokenization space is evolving rapidly, and regulatory frameworks are still adapting. Secure identity verification helps navigate this complexity by:

-

Demonstrating compliance. An optimal verification processes showcase adherence to KYC/AML and other regulations.

-

Adapting to changing requirements. Flexible verification systems can adjust to evolving regulations across different jurisdictions, ensuring compliance regardless of location.

-

Building a collaborative ecosystem. Platforms and regulators can work together to develop standardized identity verification frameworks, creating a more predictable and compliant environment.

Increased Confidence Among Participants

Investors are not faceless entities; they crave trust and transparency. Secure identity verification offers this trust by ensuring verified participants operate within the ecosystem. This attracts more investors, promotes responsible behavior, and fuels the overall health and prosperity of the tokenized asset market.

Potential for Identity Management Solutions

The evolution of identity verification doesn't stop here. Exciting developments like:

-

Decentralized identity (DID) solutions: Providing users with control over their data, offering privacy and flexibility in managing their identities.

-

Biometric authentication: Utilizing fingerprint scans, facial recognition, and other technologies for secure and convenient verification.

-

Advanced analytics: Leveraging AI and machine learning to detect suspicious activity and enhance risk management.

A Future Driven by Innovation and Collaboration

The future of identity verification in tokenization is brimming with possibilities. By utilizing Layer1 Blockchain solutions like DID, exploring biometrics, and actively collaborating with regulators, we can create a secure, inclusive, and user-centric space where trust prevails. This, in turn, will help us tap into the full potential of tokenized real-world assets, shaping a more innovative and accessible financial future for all.

In essence, when it comes to RWA tokenization, identity verification is not an option, it’s a necessity. It bridges the gap between the traditional and the digital, building a trustworthy environment, where real-world assets can create exciting possibilities for all.

Post Author

Explore Deep's insightful blog posts that help businesses stay ahead of the curve, explore new possibilities, and unlock the full potential of blockchain technology

Looking to tap into the benefits of a booming tokenized RWA market?

Tokenized RWAs are the future of investment and if you are looking to build a successful business out of it, at Codezers, we can help you with our top-notch tokenomics development services.