SHARE THIS ARTICLE

What Are Real World Assets (RWA) in DeFi and Crypto?

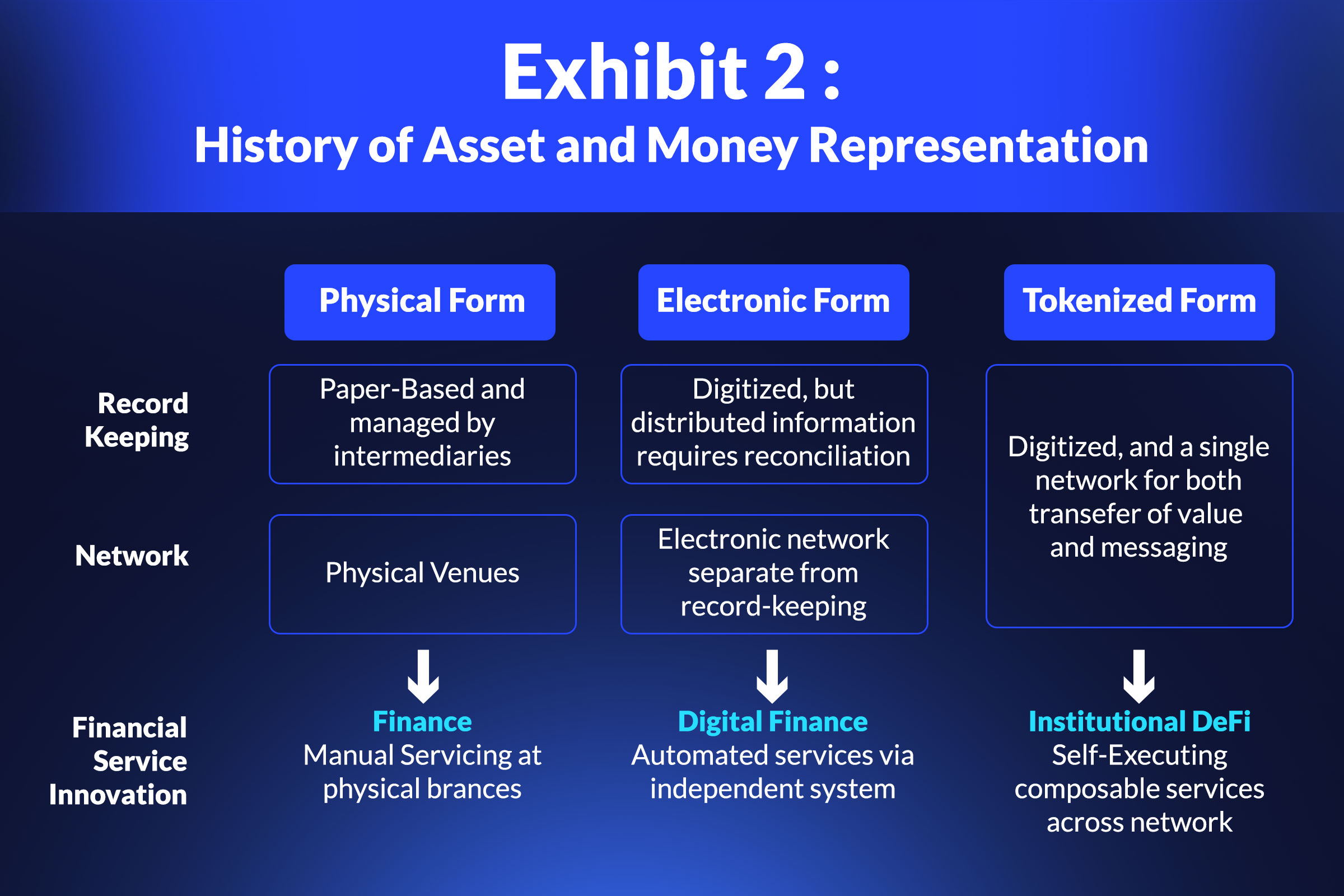

Real World Assets or RWAs for short have emerged as a promising application within decentralized finance (DeFi) and the broader cryptocurrency ecosystem. It bridges traditional finance and digital finance using tokenization blockchain development. Tokenization here refers to the conversion of assets or utilities into digital tokens. It is gaining traction fast as the on-chain RWA market is expected to reach $ 4 trillion to $16 trillion by 2030.

RWA in DeFi and crypto offers many benefits and challenges for both asset owners and investors. On one hand, RWA can provide portfolio diversification and sustainable yield and harness the incredible potential of DeFi. On the other hand, RWA can also face regulatory uncertainty, default risk, and trust issues. Therefore, it is important to understand how RWA are tokenized, how they are used in DeFi, and what are the risks and opportunities involved.

In this article, we will cover a comprehensive overview of RWA in DeFi and crypto, along with its types, mechanism of tokenization, and how it can impact the future of finance.

What Are RWAs?

Real World Assets (RWA), in the context of DeFi, are physical or intangible assets that exist outside the blockchain, such as real estate, gold, carbon credits, invoices, etc. These assets can be tokenized and brought on-chain, meaning they can be represented by digital tokens that are issued and verified on a blockchain network. This allows RWA to be integrated with decentralized finance (DeFi) and crypto – the emerging fields of financial services and applications that operate on a distributed ledger without intermediaries.

The tangible assets that RWAs represent are viable for transactions, investments, and other financial operations globally because the value and ownership of these assets are universally understood and accepted. Furthermore, they constitute a substantial portion of total global financial value. Utilizing RWAs to integrate these widely acknowledged assets into the blockchain and DeFi increases the availability of these often inaccessible financial tools. Tokenization improves their liquidity, accessibility, and transparency and makes it secure and convenient to buy, sell, or trade them on digital platforms, improving the overall experience of investors as well as asset owners.

Types of Real World Assets (RWAs)

Let’s explore some of the case studies, examples, advantages, and challenges of each type of RWA, which include real estate, commodities, securities, and others.

Tokenized Real Estate

Real estate is one of the largest and most valuable asset classes in the world, but it is also one of the most illiquid and inefficient markets. Tokenization can transform the real estate market, by enabling property owners to issue digital tokens that represent fractional ownership rights in their properties. These tokens can be traded on blockchain platforms, allowing investors to access and diversify their real estate portfolios, without having to deal with the traditional hassles and expenses of real estate transactions.

Some of the advantages of tokenized real estate are lower entry barriers and costs, faster and cheaper transfers of ownership, and increased liquidity and market efficiency. However, there are a few challenges to be overcome as well - regulatory uncertainty and complexity, technical and operational risks, and trust issues.

Prominent examples of tokenized real estate include RealT, which allows users to buy and sell tokenized real estate properties in the US, and LABS Group, which allows users to buy and sell tokenized real estate properties around the world.

Tokenized Commodities

Commodities are natural resources or goods that have a universal value and demand, such as gold, silver, oil, wheat, and coffee. Commodities are often used as a store of value, a hedge against inflation, and a diversifier of risk. However, commodities are also subject to various challenges and inefficiencies, such as high storage and transportation costs, price volatility, and market manipulation.

Tokenization can improve the commodity market, by enabling commodity producers and consumers to issue and trade digital tokens that represent physical or synthetic commodities. These tokens can be exchanged on blockchain platforms, allowing investors to access and diversify their commodity portfolios, without having to deal with the physical delivery and settlement of the commodities.

Tokenized commodities offer benefits like lower costs and risks, increased liquidity and accessibility, and enhanced transparency and traceability. However, challenges include ensuring the physical reserve's integrity, aligning with global commodity market dynamics, and navigating regulatory landscapes that vary across jurisdictions.

Platforms like Commodities.com are exploring this frontier, offering tokenized commodities backed by physical reserves.

Tokenized Securities

Securities are financial instruments that represent ownership or debt rights in a company, fund, or project, such as stocks, bonds, or derivatives. Securities are often used as a source of capital, income, and growth. However, securities are also subject to various challenges and inefficiencies, such as high barriers, costs, and frictions involved in issuing, trading, and managing securities.

Tokenization can revolutionize the securities market, by enabling security issuers and investors to issue and trade digital tokens that represent securities. These tokens can be exchanged on blockchain platforms, allowing investors to access and diversify their securities portfolios, without having to deal with the traditional intermediaries and processes of the securities market.

Primary advantages of tokenized securities include lower barriers and costs, increased liquidity and accessibility, and enhanced transparency and compliance. However, regulatory considerations are crucial here, as security tokens often fall under existing securities regulations. Striking the right balance between compliance and the benefits of decentralized finance is a challenge that projects in this space must navigate.

Tokenized securities are Securitize, which allows users to issue and trade tokenized securities on the Ethereum blockchain, and Centrifuge, which allows users to tokenize real-world assets and use them as collateral for DeFi lending – have been instrumental in advancing the space.

Other Examples of RWAs

Beyond real estate, commodities, and securities, the tokenization of various other assets is gaining traction in DeFi. Carbon credits, for instance, can be tokenized to enable environmentally conscious investments. Then there are invoices, which represent future cash flows and are being explored for trade finance on blockchain networks. Even traditional assets like US Treasuries are embracing tokenization's transformative potential. These examples showcase the versatility of RWA in DeFi, introducing unique ways to engage with assets normally confined to traditional financial systems. As with any innovation, challenges persist, including regulatory clarity and establishing robust frameworks for tokenizing these diverse assets.

Some examples of these types of RWA are Aavegotchi, which allows users to buy and sell tokenized carbon credits, MakerDAO, which allows users to use tokenized US Treasuries as collateral for stablecoins, and Creditcoin, which allows users to lend and borrow tokenized invoices.

Benefits of Real World Assets in DeFi

Real World Assets (RWA) in DeFi transcend the boundaries of traditional finance and tap into a wealth of benefits that the blockchain provides.

Diversification of Assets

One of the advantages of RWA in DeFi is that they can provide portfolio diversification for investors who want to reduce their exposure to the volatility and risk of crypto assets. RWAs tend to have lower correlation and higher stability than most crypto assets, which means they can balance out the fluctuations and losses of the crypto market. For example, tokenized gold can act as a hedge against inflation and currency devaluation, while tokenized real estate can generate steady income and appreciation.

Moreover, RWA can also offer access to a wider range of asset classes and markets that are otherwise inaccessible or illiquid for crypto investors. For instance, tokenized carbon credits can enable investors to participate in the green economy and support environmental causes while tokenized invoices can allow investors to lend money to small businesses and earn interest.

Bridging Traditional Finance and DeFi

Another benefit of RWAs is that they can bridge the gap between traditional finance (TradFi) and DeFi, creating a more inclusive and efficient financial system. RWA can enable asset owners to leverage their existing assets and tap into the DeFi ecosystem, which offers lower barriers, higher returns, and more innovation than TradFi. For example, tokenized real estate owners can use their properties as collateral to borrow stablecoins from DeFi protocols, and use them for various purposes, such as paying bills, investing in other assets, or starting a business.

On the other hand, RWA can also attract more capital and attention from TradFi to DeFi, increasing the adoption and growth of the DeFi sector. RWA can appeal to institutional and retail investors who are looking for more regulated, compliant, and familiar assets to invest in DeFi. For example, tokenized US Treasuries can provide a safe and reliable way for investors to enter the DeFi space, while tokenized securities can offer exposure to the performance and dividends of companies and funds.

Potential for Increased Liquidity

RWAs can potentially increase the liquidity and efficiency of both the physical and digital markets. They can make the physical assets more liquid and tradable, by breaking them down into smaller and fractional units, and by removing the intermediaries and frictions involved in the transactions. For instance, tokenized real estate can lower the entry barriers and costs for buying and selling properties by allowing investors to purchase smaller and more affordable shares of a property, rather than having to buy the whole property or a large stake. This lowers the minimum investment amount and the associated fees, such as taxes, commissions, and legal costs. Furthermore, Tokenization also simplifies the process of transferring ownership rights in a property, by eliminating the need for intermediaries, such as brokers, agents, and lawyers.

Similarly, RWA can also make digital assets more liquid and accessible, by creating more supply and demand, and by enhancing the interoperability and composability of the DeFi protocols. To exemplify this fact: tokenized commodities can increase the availability and variety of collateral and underlying assets for DeFi lending, borrowing, and investing platforms, and enable more complex and innovative financial products and services.

Mechanisms for Tokenizing Real World Assets

Tokenization of RWAs involves a complex interplay of various technical and operational steps. Here are the main mechanisms and components of the process.

Process of RWA Tokenization

The process of RWA tokenization can be divided into three main stages: off-chain formalization, information bridging, and RWA protocol demand and supply.

-

Off-chain formalization: This stage involves the identification and verification of the RWA, the establishment of the legal framework and ownership rights, and the creation of the security tokens that represent the RWA. The process requires the involvement of various parties, such as the asset owners, the token issuers, the regulators, the lawyers, and the auditors.

-

Information bridging: The transfer and synchronization of the RWA data and documents from the off-chain world to the on-chain world are the primary aspects of this stage. It necessitates the use of decentralized oracles, which are services that provide reliable and secure real-world data to the blockchain. We will discuss more about decentralized oracles in the next subsection.

-

RWA protocol demand and supply: This stage encompasses the listing and trading of the RWA tokens on blockchain platforms, such as the DeFi protocols and the exchanges. Moreover, the creation and maintenance of the market liquidity and efficiency, as well as the compliance and governance of the RWA tokens play a crucial role.

Blockchain Technology

Blockchain technology is the core infrastructure that enables the tokenization of RWA, as it provides the features and functionalities that are essential for the issuance, management, and exchange of RWA tokens, such as smart contracts, interoperability, and security.

-

Smart contracts: Smart contracts automate and enforce the terms and conditions of the RWA tokenization, such as the issuance, the transfer, the dividend, and the redemption. Smart contracts can also embed and comply with the regulatory and contractual rules and obligations of the RWA, such as the KYC, the AML, and the investor rights.

-

Interoperability: Interoperability enhances the accessibility and diversity of the RWA tokens, as it allows them to be used across various platforms and applications, such as the DeFi lending, borrowing, and investing platforms. Interoperability can also enable the integration and collaboration of different types of RWA tokens, such as real estate, commodities, and securities.

-

Security: Security ensures the integrity and reliability of the RWA tokenization, as it prevents the loss of funds, data breaches, disputes, or damages. Security can be achieved by using various methods and technologies, such as encryption, consensus, and authentication.

Decentralized Oracles

Decentralized oracles are services that provide reliable and secure real-world data to the blockchain, such as the price, the quality, and the status of the RWA. Decentralized oracles are crucial for the tokenization of RWA, as they enable the information bridging between the off-chain world and the on-chain world.

-

Ensuring real-world data accuracy: Decentralized oracles ensure the accuracy of the real-world data that is used for the RWA tokenization, such as the provenance, valuation, and ownership of the RWA. Decentralized oracles use various mechanisms and incentives to verify and validate the data sources and providers, such as reputation, staking, and voting.

-

Oracle networks: Oracle networks improve the scalability and efficiency of the RWA tokenization, as they can handle large amounts of data and requests, and provide faster and cheaper data delivery. Oracle networks can also increase the diversity and redundancy of real-world data, as they can use multiple data sources and providers, and cross-check and compare the data.

Projects and Platforms in the RWA Space

The rapid evolution of decentralized finance (DeFi) has given rise to a multitude of projects and platforms pioneering the tokenization of real-world assets (RWAs) and offering tokenization blockchain services. Below are some of the projects and platforms that are leading the RWA space in DeFi.

Securitize

Securitize allows users to issue and trade tokenized securities on the Ethereum blockchain. It provides a suite of tools and services that enable security issuers and investors to comply with the regulatory and contractual requirements of the securities market, such as the KYC, the AML, the investor rights, and the dividend distribution. Some of the use cases of Securitize are Blockchain Capital and SPiCE VC, which are venture capital funds that issued tokenized shares of their funds, and allowed investors to benefit from their performance and dividends.

Centrifuge

Centrifuge is a platform that helps users tokenize real-world assets and use them as collateral for DeFi lending. It leverages the Polkadot network to enable cross-chain interoperability and scalability, and integrates with various DeFi protocols, such as MakerDAO, Aave, and Compound, to provide liquidity and yield opportunities. One of the features of Centrifuge is Tinlake, which is a set of smart contracts that enable users to create and manage pools of RWA tokens and to issue stablecoins that are backed by the RWA tokens. Some of the case studies of Centrifuge are New Silver and Paperchain, which are platforms that tokenized their real estate loans and music streaming revenue and used them as collateral for borrowing DAI from MakerDAO.

Other Notable Projects

Besides Securitize and Centrifuge, there are other notable projects and platforms that are involved in the RWA space.

stUSDT:

-

Overview: stUSDT is a stablecoin project backed by U.S. Treasury bills, which are short-term debt instruments issued by the U.S. government. It aims to bridge the gap between traditional finance and DeFi by tokenizing US dollars.

-

Contribution: By representing US dollars as tokens on the blockchain, stUSDT enhances the liquidity and accessibility of fiat currencies within the DeFi ecosystem.

Ondo Finance:

-

Overview: Ondo Finance focuses on decentralized lending and borrowing, providing a platform for the tokenization of various assets.

-

Contribution: By enabling the tokenization of assets, Ondo Finance enhances the efficiency and inclusivity of lending markets within the decentralized finance space.

Backed Finance:

-

Overview: Backed Finance is dedicated to creating decentralized financial products by tokenizing real-world assets.

-

Contribution: Backed Finance's approach to tokenizing assets contributes to the development of decentralized financial instruments, expanding the scope of possibilities within the DeFi landscape.

MakerDAO:

-

Overview: MakerDAO is a decentralized autonomous organization that governs the Maker protocol, including the issuance of the stablecoin DAI.

-

Contribution: MakerDAO plays a crucial role in the DeFi space by providing a stablecoin that is collateralized by a variety of assets, contributing to stability and liquidity.

Creditcoin:

-

Overview: Creditcoin focuses on tokenizing debt, providing a platform for the creation and trading of tokenized debt instruments.

-

Contribution: By tokenizing debt, Creditcoin introduces new possibilities for decentralized lending and borrowing, creating a more dynamic and accessible credit market.

Maple Finance:

-

Overview: Maple Finance is a decentralized lending platform that allows institutional and individual investors to participate in decentralized lending markets.

-

Contribution: Maple Finance contributes to the DeFi ecosystem by providing a decentralized platform for borrowers and lenders to interact, fostering a more inclusive lending environment.

Goldfinch:

-

Overview: Goldfinch is a decentralized protocol for unsecured lending, providing a platform for borrowers to access capital without collateral.

-

Contribution: Goldfinch's focus on unsecured lending expands the scope of possibilities within the DeFi lending space, allowing borrowers to access capital without the need for traditional collateral.

Risks and Challenges of Tokenizing Real-World Assets

Despite its potential benefits, tokenization of real-world assets (RWA) faces several challenges that must be addressed for successful implementation. Some of the main challenges are:

Regulatory and legal frameworks: The Tokenization of RWA involves various legal and regulatory issues, such as the definition and classification of RWA tokens, the compliance and reporting requirements, and the jurisdiction and enforcement mechanisms. Different countries and regions may have different laws and regulations regarding RWA and securities, which may create conflicts and inconsistencies for token issuers and investors.

Asset valuation and price discovery: It requires accurate and reliable methods of valuing and pricing the underlying assets, as well as the tokens that represent them. However, RWA may have complex and dynamic characteristics, such as quality, condition, location, and market demand, which may affect their value and price. Moreover, RWA tokens may have limited liquidity and market depth, which may affect their price discovery and volatility.

Custody and asset management: Secure and trustworthy custody and management of both the physical and digital assets, as well as the alignment of the rights and obligations of the token holders and the asset owners play a key role in the tokenization of RWAs. RWA may pose various technical and operational risks, such as the security and reliability of the blockchain platforms, the accuracy and validity of the asset data and documents, and the management and maintenance of the physical assets. These risks may result in loss of funds, data breaches, disputes, or damages.

Possible Solutions and Best Practices

Some possible solutions and best practices to overcome and mitigate the challenges and risks of RWA tokenization are:

-

Standardization: Creating and adopting common and consistent standards, rules, and protocols to simplify, streamline, and improve the RWA tokenization process and outcomes.

-

Verification: Ensuring and validating the accuracy, validity, and quality of the data and information that are used for the RWA tokenization, and providing verifiable and immutable records of the RWA tokens.

-

Governance: Establishing and enforcing the rules, roles, and responsibilities of the parties and stakeholders involved in the RWA tokenization, and resolving and preventing the disputes and conflicts that may arise.

Future Trends and Developments

Future Trends and Developments RWA in DeFi and crypto are expected to grow and change significantly in the future, as they offer new opportunities and benefits for both asset owners and investors. Some of the future trends and developments that may shape the RWA space are:

-

The regulatory landscape may affect the compliance, accessibility, and liquidity of the RWA tokens, as well as the legal certainty and protection of the token issuers and investors.

-

The integration of layer 2 solutions may enhance the scalability and efficiency of the RWA tokenization, and improve the interoperability and compatibility of the RWA tokens and the blockchain platforms.

-

The increased collaboration between DeFi and traditional finance may create new synergies and value propositions for the RWA tokenization, and foster the adoption and integration of the RWA tokens.

-

The market size, innovation, and adoption are expected to grow and diversify as more types and categories of RWA are tokenized and brought on-chain, and as the RWA tokenization mechanisms and components are developed and improved.

Wrapping It Up

The future of RWAs in DeFi holds immense promise. As regulatory frameworks evolve, we anticipate increased integration between traditional and decentralized finance. The ongoing development of interoperable solutions and the maturation of security protocols will likely enhance the efficiency and security of RWA tokenization. Continued innovation and collaboration between projects will contribute to the growth and acceptance of tokenized real-world assets within the broader financial ecosystem.

For a deeper dive into the world of decentralized finance and real-world asset tokenization, stay connected with Codezeros, a leading token development company. Explore our tech solutions and stay ahead of the curve when it comes to constantly evolving blockchain technology and DeFi.

Post Author

As a distinguished blockchain expert at Codezeros, Paritosh contributes to the company's growth by leveraging his expertise in the field. His forward-thinking mindset and deep industry knowledge position Codezeros at the forefront of blockchain advancements.

What are RWAs in DeFi and Crypto

Harness the potential of tokenized RWAs for your next DeFi project. At Codezeros, we offer cutting-edge tokenization blockchain services. We are one of your best bets for creating DeFi platforms that facilitate the trading of RWAs and other tokenized assets.